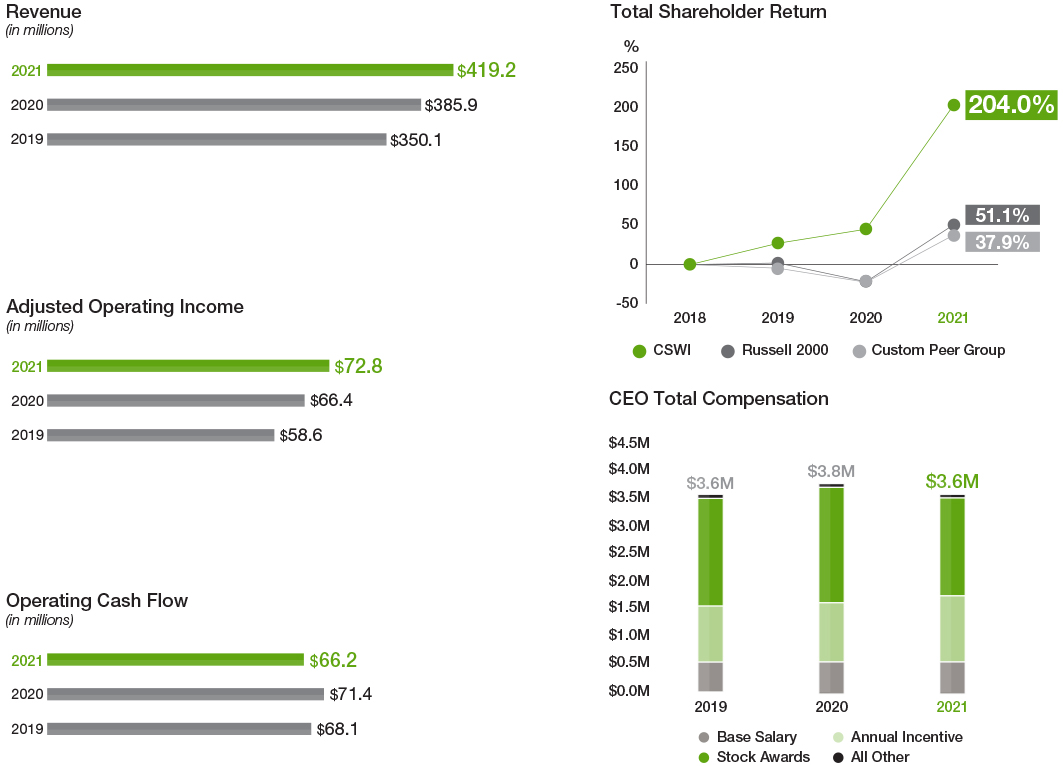

Fiscal 2021 Performance Highlights

Fiscal 2021 was a historic year for CSWI. The year began with the opportunity to continue building momentum on our outstanding fiscal 2020 performance. However, global events, including the COVID-19 pandemic and resulting economic crisis, challenged our leadership team in multiple, unprecedented ways. Despite these challenges, Mr. Armes and the CSWI executive team led the Company well, successfully adapting to rapidly changing business, economic, and social conditions.

Our achievements were enabled by the strength of our diversified business model, our team’s tireless work and dedication, and our strategic, disciplined allocation of capital. During the year and with the support of our strong balance sheet, we executed on all aspects of our capital allocation strategy: we acquired TRUaire, returned $15.4 million to stockholders through dividends and share repurchases, invested $8.8 million in capital expenditures for organic growth, and just after year end formed the Shell & Whitmore Reliability Solutions joint venture.

Actions We Took in Response to COVID-19

We manufacture products that are considered essential to critical infrastructure. Additionally, we believe that our employees are our most valuable asset and that our skilled, engaged workforce provides us with a competitive advantage. We are committed to creating and maintaining a safe, healthy working environment, and we have developed a health and safety program that focuses on ensuring our employees understand this commitment. This year underscored for us the importance of keeping our employees safe and healthy. In response to the pandemic, we developed a business continuity plan that was aligned with guidance from the World Health Organization and the Centers for Disease Control and Prevention to protect the health and safety of our workforce and enable us to continue to serve our customers.

All our production sites have maintained operations throughout the pandemic with minimal disruption. To enable this business continuity, we mobilized nearly 100% of our non-manufacturing employees to |

|

Board of Directors Highlights

|

Name |

Age |

Director Since |

Occupation |

Independent |

Committee Memberships |

||

Audit |

Comp & Talent Dev |

Nom & Gov |

||||||

|

Joseph B. Armes |

59 |

2015 |

Chairman, CEO and President, CSW Industrials, Inc. |

|

|

|

|

|

Michael R. Gambrell |

67 |

2015 |

Former EVP, The Dow Chemical Company |

• |

|

• |

• |

|

Terry L. Johnston |

63 |

2017 |

Former EVP and COO, Commercial Segment, Lennox International |

• |

• |

|

• |

|

Linda A. Livingstone, Ph.D. |

61 |

2015 |

President, Baylor University |

• |

|

◊ |

|

|

William F. Quinn* |

73 |

2015 |

Former Executive Chairman, American Beacon Advisors |

• |

◊ |

• |

|

|

Robert M. Swartz (Lead Independent Director) |

69 |

2015 |

Former EVP and COO, Glazer’s Inc. |

• |

• |

|

◊ |

|

J. Kent Sweezey |

68 |

2016 |

Founding Partner, Turnbridge Capital, LLC |

• |

• |

• |

|

|

Debra L. von Storch |

61 |

2020 |

Former Partner, Ernst & Young LLP |

• |

• |

|

|

Not nominated for reelection at this Annual Meeting due to planned retirement pursuant to the age limitation provision in our Corporate Governance Guidelines.

Mr. Quinn, who was one of our inaugural Board members when we became an independent public company in September 2015, is retiring effective as of the Annual Meeting. We thank Mr. Quinn for his years of distinguished service to CSWI.

Governance Highlights

Board Independence |

•

Seven of our eight Board members are independent •

Our CEO is our only management director |

Board Composition |

•

All Board members are elected annually •

The Board regularly assesses and evaluates its performance and the performance of its committees •

The Nominating & Corporate Governance Committee leads the full Board in considering Board competencies in light of Company strategy •

29% of our Board nominees are female |

Board Committees |

•

We have three committees — Audit; Compensation & Talent Development; and Nominating & Corporate Governance •

All committees are composed entirely of independent directors |

Leadership Structure |

•

Our Board has a lead independent director that works closely with our Chairman, CEO and President in fulfilling responsibilities and duties •

Among other duties, our lead independent director chairs executive sessions of the independent directors |

Environmental, Social & Governance Oversight |

•

Our Nominating & Corporate Governance Committee oversees our Environmental, Social & Governance (ESG) Program |

Risk Oversight |

•

Our Board is responsible for enterprise risk oversight and has designated committees with specific oversight of certain key risks •

Our Audit Committee oversees administration of the Company’s Enterprise Risk Management (ERM) Program for the assessment and mitigation of key risks |

Open Communication |

•

We encourage open communication and strong working relationships among the lead independent director, Chairman and other directors •

Our directors have direct access to management and employees |

Stock Ownership |

•

Our directors and executive officers are subject to robust stock ownership requirements |

Stockholder Engagement

We are actively engaged with our investors. Our senior leaders participate in numerous industry and analyst conferences throughout the year, and we have dedicated resources to engage with all stockholders through a variety of mediums. The table below summarizes our engagement efforts in fiscal 2021.

Executive Compensation Highlights

Executive Compensation Program Objectives and Elements

The Compensation Committee has designed our executive compensation program to support CSWI’s growth strategy. Our key executive compensation objectives are:

In furtherance of these objectives, the Compensation Committee maintains a thoughtful approach to our executive compensation program design and governance practices. The following table summarizes these practices.

What We Do |

|

What We Don’t Do |

||

|

Promote a strong pay for performance plan design |

|

|

No hedging, pledging, or short sales of stock permitted |

|

Regularly benchmark executive compensation against peers of comparable size, complexity, and industry |

|

|

No change in control excise tax gross-ups |

|

Maintain meaningful stock ownership guidelines for our directors and executive officers |

|

|

No option repricing without stockholder approval |

|

Have double trigger requirements for cash payments following a change in control |

|

|

No perquisites offered, other than those generally provided to all employees |

|

Conduct an annual compensation risk review |

|

|

No dividends paid and no voting rights on unvested performance-based equity awards |

|

Provide reasonable and standardized benefits upon severance or change in control |

|

|

No duplication of metrics in annual and long-term incentive plans |

|

Engage an independent compensation consultant |

|

|

No supplemental executive retirement plans |

|

Maintain an incentive compensation “clawback” policy |

|

||

Element |

Form |

Compensation Objective Addressed |

|

Base Salary |

Cash |

|

Reward Current Performance |

|

|

|

Attract and Retain |

Annual Incentive |

Performance Cash Award |

|

Stockholder Alignment |

|

|

|

Reward Current Performance |

|

|

|

Attract and Retain |

Long-Term Equity Incentive |

Performance Shares |

|

Stockholder Alignment |

|

|

Drive Future Performance |

|

|

Attract and Retain |

||

|

|

|

|

|

Restricted Stock |

|

Stockholder Alignment |

|

|

|

Drive Future Performance |

|

|

Attract and Retain |

|

|

|

|

|

Proposal

One:

Election of Directors

The Company’s Board currently consists of eight directors. William Quinn will retire from the Board effective as of the Annual Meeting pursuant to the age limitation provision in our Corporate Governance Guidelines and is therefore not nominated for reelection. Mr. Quinn was one of our inaugural Board members when we became an independent public company in September 2015 and has contributed meaningfully to making CSW Industrials the company it is today. We thank Mr. Quinn for the years of distinguished service he has provided to the Company and the important leadership role he has played in our collective success.

The Board has nominated Joseph Armes, Michael Gambrell, Terry Johnston, Linda Livingstone, Robert Swartz, Kent Sweezey and Debra von Storch, whose terms of office are expiring at this 2021 Annual Meeting, to serve a one-year term that will expire at the 2022 annual meeting of stockholders. All of the nominees were elected by stockholders at the 2020 annual meeting. Biographical information regarding the nominees is provided on the following pages.

Required Vote and Recommendation

Our Bylaws provide that, in an uncontested election, each director nominee will be elected by a majority of the votes cast in person or represented by proxy. This means that the number of shares cast “for” a nominee’s election must exceed the number of votes “withheld” from that nominee. If this were a contested election, the directors would be elected by a plurality of the votes cast, meaning the nominees receiving the largest number of “for” votes would be elected. For more information, see “General Voting and Meeting Information—Counting of Votes.”

Our Corporate Governance Guidelines provide that in an uncontested election, any incumbent director who does not receive the affirmative vote of a majority of the votes cast must tender his or her resignation promptly after such election. The remaining independent directors of the Board, giving due consideration to the best interests of CSWI and our stockholders, will then evaluate the relevant facts and circumstances and make a decision, within 30 days after election results are certified, on whether to accept the tendered resignation. The Board will promptly disclose publicly its decision and, if applicable, the reasons for rejecting the tendered resignation. The Board may fill any vacancy resulting from a director’s accepted resignation.

The individuals named as proxies on the enclosed proxy card will vote your proxy “FOR” the election of these nominees unless you instruct otherwise or you withhold authority to vote for any one or more of the nominees. If any director is unable to stand for re-election, the Board may reduce the number of directors or choose a substitute nominee. The nominees have indicated their willingness to serve as directors, and we have no reason to believe the nominees will not be able to stand for re-election.

Board of Directors — Biographical Information

Nominees to Serve a Term Expiring at the 2022 Annual Meeting of Stockholders

JOSEPH B. ARMES |

|||

Chairman of the Board, Chief Executive Officer & President, CSW Industrials |

|||

Age 59 Director since: September 2015 |

Professional Highlights: |

||

Mr. Armes has served as Chief Executive Officer and Chairman of the Board of Directors of the Company since September 2015, and as President of the Company since February 2018. Prior to the Company’s spin-off in September 2015 from Capital Southwest Corporation, Mr. Armes served as the Chief Executive Officer and President of Capital Southwest Corporation from June 2013 to September 2015, and as Chairman of the Board from January 2014 through August 2017. |

|||

Key Skills and Qualifications: |

|||

We believe Mr. Armes is well qualified to serve as a director due to his position as the Company’s Chief Executive Officer, which provides the Board with knowledge of the Company’s day-to-day operations. Mr. Armes also has broad executive and board leadership experience, finance and accounting expertise, compliance and governance expertise, and corporate development experience, all of which support the Company’s strategic growth plans. |

|||

CSWI Board Committee(s) |

Other Public Company Directorships: |

||

•

None |

•

Switchback Energy Acquisition Corp. (2019-2021) •

RSP Permian, Inc. (2013-2018) •

Capital Southwest Corporation (2013-2017) |

||

MICHAEL R. GAMBRELL |

|||

Former Executive Vice President, The Dow Chemical Company |

|||

Age 67 Director since: September 2015 INDEPENDENT |

Professional Highlights: |

||

Mr. Gambrell had a 37-year career at The Dow Chemical Company, a publicly traded chemicals company (now Dow, Inc.), most recently serving as an Executive Vice President and an advisor to the Chairman and CEO of Dow. During his time at Dow, Mr. Gambrell served on the company’s Executive Leadership Committee, Strategy Board, Sustainability Team, and Geographic Leadership Council, and he was an ex officio member of the board’s Environment, Health and Safety Committee. In 2012, Mr. Gambrell founded GamCo, LLC, a privately-held company providing advisory services to public, private equity, and start-up companies as well as non-profit organizations. He served as Chairman of the Campbell Institute from 2012 to 2015, and as a director and member of the Executive Committee and Strategic Planning Committee of the National Safety Council from 2011 to 2015. |

|||

Key Skills and Qualifications: |

|||

We believe Mr. Gambrell is well qualified to serve as a director due to his executive and board leadership experience and his extensive knowledge of the chemicals industry, which provide a global perspective and deep understanding of the Company’s products, customers, end markets, competitive landscape, and operational challenges and opportunities. In addition, Mr. Gambrell has extensive corporate development experience and integration expertise, as well as knowledge and experience in addressing health, safety and environmental issues, which provides the Board unique insight into the Company’s strategic growth plans. |

|||

CSWI Board Committee(s): |

Other Public Company Directorships: |

||

•

Compensation & Talent Development •

Nominating & Corporate Governance |

•

TRW Automotive Inc. (2007-2015) |

||

TERRY L. JOHNSTON |

||

Former Executive Vice President & COO, Commercial Segment, Lennox International |

||

Age 63 Director since: January 2017 INDEPENDENT |

Professional Highlights: |

|

Mr. Johnston was Executive Vice President and Chief Operating Officer of the Commercial Segment of Lennox International Inc., a leading international provider of heating and cooling systems and technologies for residential and commercial applications, from 2013 until October 2019. Before assuming that position, Mr. Johnston held roles of increasing responsibility with Lennox International from the time he joined the company in 2001. Prior to his time with Lennox International, Mr. Johnston spent 20 years with General Electric Company, serving primarily in marketing and commercial leadership roles. |

||

Key Skills and Qualifications: |

||

We believe Mr. Johnston is well qualified to serve as a director due to his executive leadership experience and extensive knowledge of the Company’s served industrial markets. In addition, Mr. Johnston has extensive strategic planning experience and operational and commercial expertise, which provides the Board with a global perspective and positions him well to support the Company’s growth strategy and manufacturing optimization focus. |

||

CSWI Board Committee(s): |

||

•

Audit •

Nominating & Corporate Governance |

||

LINDA A. LIVINGSTONE, PH.D. |

||

President, Baylor University |

||

Age 61 Director since: September 2015 INDEPENDENT |

Professional Highlights: |

|

Dr. Livingstone is President of Baylor University, a position she has held since June 2017. From August 2014 through May 2017, she served as Dean of The George Washington University School of Business, and she previously served as Dean of the Graziadio School of Business and Management at Pepperdine University for twelve years. Dr. Livingstone began her academic career at Baylor University, where she served for eleven years as an Assistant and then Associate Professor of Management, which included serving for four years as Associate Dean for Graduate Programs. Dr. Livingstone currently serves on the Board of Directors and as a member of the Executive Committee for each of the American Council on Education and the Big 12 Conference. She also serves on the NCAA Board of Governors and the NCAA Division 1 Board of Directors, as well as the Board of Directors of Independent Colleges and Universities of Texas. |

||

Key Skills and Qualifications: |

||

We believe Dr. Livingstone is well qualified to serve as a director due to her extensive leadership experience as an administrator and educator in the field of business administration, which provides the Board a valuable perspective on organizational development, corporate governance, information security, executive compensation and leadership development matters. |

||

CSWI Board Committee(s): |

||

•

Compensation & Talent Development (Chair) |

||

ROBERT M. SWARTZ |

|||

Former Executive Vice President & COO, Glazer’s, Inc. |

|||

Age 69 Director since: September 2015 Lead

INDEPENDENT |

Professional Highlights: |

||

From January 2011 until June 2016, Mr. Swartz served as the Executive Vice President and Chief Operating Officer for Glazer’s, Inc., a privately-held distributor of wines and spirits, prior to Glazer’s combination with Southern Wine and Spirits. For the remainder of 2016, Mr. Swartz oversaw the integration of the combined company, Southern Glazer’s Wine and Spirits of America. Since January 2017, Mr. Swartz has served as a member of the board of managers of Glazer’s Beer & Beverage, LLC. Since 2018, Mr. Swartz has been a partner in Northaven Capital Partners, a lower middle market private equity firm focused on businesses headquartered in the southwestern U.S. Additionally, Mr. Swartz served in various executive positions at Centex Corporation from 1999 to 2007. |

|||

Key Skills and Qualifications: |

|||

We believe Mr. Swartz is well qualified to serve as a director due to his experience and expertise in corporate development, finance and accounting. Mr. Swartz also has extensive executive and board leadership experience as well as deep operational expertise that provides the Board with insight into the Company’s operations and leadership development opportunities. |

|||

CSWI Board Committee(s): |

Other Public Company Directorships: |

||

•

Nominating & Corporate Governance (Chair) •

Audit |

•

Resolute Energy Corporation (2009-2015) |

||

J. KENT SWEEZEY |

||

Founding Partner, Turnbridge Capital, LLC |

||

Age 68 Director since: December 2016 INDEPENDENT |

Professional Highlights: |

|

Mr. Sweezey is a founding partner of Turnbridge Capital, LLC, an energy services, equipment and infrastructure-focused private equity firm, which was founded in 2008. He currently serves as a member of the board of directors of Impact Selector, Inc., a privately-held company. Prior to co-founding Turnbridge Capital, Mr. Sweezey served as the Managing Partner of Centre Southwest Partners, LLC, a middle-market private equity firm focused primarily on energy services and equipment-related investments. Prior to his time with Centre Southwest Partners, Mr. Sweezey was with Donaldson, Lufkin & Jenrette (“DLJ”) and its successor firm, Credit Suisse First Boston, where he focused on transactions in the energy sector, as well as in the consumer products, building products, and manufacturing sectors. Mr. Sweezey was also involved in DLJ’s early principal investing activities through its investments in Seven-Up Company, Dr Pepper/Seven-Up Companies, and Dr Pepper Bottling Company of Texas, where he served on the board of directors from 1989 to 1999. |

||

Key Skills and Qualifications: |

||

We believe Mr. Sweezey is well qualified to serve as a director due to his executive leadership experience, strategic acquisition and financial expertise, and governance expertise. His extensive experience in corporate development matters positions him well to support the execution of the Company’s growth strategy and capital allocation plans. |

||

CSWI Board Committee(s): |

||

•

Audit •

Compensation & Talent Development |

||

DEBRA L. VON STORCH |

|||

Former Partner, Ernst & Young LLP |

|||

Age 61 Director since: January 2020 INDEPENDENT |

Professional Highlights: |

||

Ms. von Storch was a partner of Ernst & Young LLP, a leading international accounting and advisory services firm, until she retired in June 2020 after 38 years with the firm. While with Ernst & Young, she most recently served as the lead partner for southwest region growth markets, a position she held for ten years. She previously held roles of increasing responsibility within the firm, where her practice focused on providing global business leadership, strategic tax and transaction planning, capital markets advice, and advisory services to high-growth companies. Since June 2021, Ms. von Storch has served as a board member of the NACD North Texas chapter, and she also serves as a member of the advisory board for Varidesk, LLC. |

|||

Key Skills and Qualifications: |

|||

We believe Ms. von Storch is well qualified to serve as a director due to her leadership experience, strong strategic and financial acumen, and information security and risk management expertise. Her extensive experience in successfully advising high-growth companies throughout the globe through all stages of a company lifecycle positions her well to advise on and support the execution of the Company’s growth strategy and capital allocation plans. |

|||

CSWI Board Committee(s): |

Other Public Company Directorships: |

||

•

Audit |

•

Canoo Inc. (2021-present) |

||

Governance Overview

The Board has a responsibility to oversee the Chief Executive Officer and other members of senior management in the competent and ethical operation of the Company and to ensure that our stockholders’ best interests are being served. To meet this responsibility, the Board has established Corporate Governance Guidelines designed to promote effective oversight of the Company’s business affairs. The Board monitors and updates these Guidelines periodically as it deems appropriate.

The Corporate Governance Guidelines are available on the Company’s website at www.cswindustrials.com under the “Investors — Corporate Governance” caption.

Board Independence

Our Corporate Governance Guidelines require that a majority of the Board members satisfy applicable independence requirements set forth in NASDAQ listing rules and under applicable law. Only those directors who have no material relationship with the Company (except in their role as a director) are deemed independent. The Board has determined that, other than Mr. Armes, who is the Company’s Chairman, Chief Executive Officer and President, each member of the Board meets the independence standards set forth in the applicable rules of the Securities and Exchange Commission (the “SEC”) and NASDAQ.

Board Composition

What We Look for in Director Candidates

Before considering director nominee candidates, the N&CG Committee assesses whether the Board’s current size and composition are appropriate and whether any vacancies on the Board are expected due to retirement, age limits or other factors. If additional directors are needed or vacancies are anticipated or otherwise arise, the N&CG Committee utilizes a variety of methods for identifying and evaluating possible nominees.

The Company’s Corporate Governance Guidelines establish the criteria for Board membership. As a starting point, the N&CG Committee assesses a director candidate’s judgment, skill, diversity, integrity, experience with business and other organizations of comparable size, and the interplay of the candidate’s experience with the experience of current Board members. In evaluating these characteristics, including diversity, the Board considers individual qualities and attributes, such as educational background, professional skills, business experience, and cultural viewpoint, as well as more categorical diversity metrics, such as race and ethnicity, gender, and age. The Board considers whether this evaluation process is effective in promoting diversity during its annual self-assessment process.

Board Committees

The Board maintains an Audit Committee, a Compensation & Talent Development Committee (“Compensation Committee”) and a N&CG Committee. Only independent directors are eligible to serve on these standing Board committees. Each committee is governed by a written charter, all of which are available on the Company’s website at www.cswindustrials.com under “Investors — Corporate Governance.”

The Board has determined that all members of all committees meet the independence standards of the SEC and NASDAQ, including the heightened independence requirements for certain committee members.

Audit Committee

Members and Other Information |

Primary Oversight Responsibilities |

Committee Chair: William Quinn

Other Members: Terry Johnston Robert Swartz J. Kent Sweezey Debra von Storch

5 Meetings in Fiscal 2021 |

•

Engage the Company’s independent auditors and approve the scope of the annual external audit •

Approve any audit and non-audit services provided by the independent auditor •

Meet regularly with the independent auditors in executive session to discuss audit reports and auditor recommendations on a confidential basis •

Oversee financial reporting processes, including the integrity of the Company’s financial statements and compliance with legal and regulatory requirements •

Oversee internal controls matters, which includes information security and cybersecurity risk •

Oversee the Company’s compliance program, including the Company’s Code of Business Conduct and Ethics •

Oversee management’s administration of the Enterprise Risk Management program |

Board of Directors Compensation

2021 Director Compensation Elements

In fiscal 2021, non-employee directors received, as applicable: (a) an annual cash retainer of $60,000; (b) equity compensation with a target value of $85,000; and (c) individual retainers and meeting participation fees according to the following schedule:

Director Fee Element |

Fees ($) |

Lead Independent Director Retainer (annual) |

23,750 |

Audit Committee Chair Retainer (annual) |

19,375 |

Compensation Committee Chair Retainer (annual) |

12,000 |

N&CG Committee Chair Retainer (annual) |

10,000 |

Full Board Meeting Fee (per meeting) |

2,000 |

Committee Meeting Fee (per meeting) |

2,000 |

These compensation elements and the associated amounts were unchanged from fiscal 2020. The existing compensation elements and amounts were established by the Board after a review of data prepared by Longnecker & Associates, the Compensation Committee’s independent consultants, that showed competitive director compensation levels among the market generally and among the Company’s compensation peer group, which is discussed under “Executive Compensation—Executive Compensation Program Principles.”

The equity portion of non-employee director compensation is provided in the form of restricted stock of the Company having a target value of $85,000 on the date of grant. This equity grant value has been in place since fiscal 2019, and was based on competitive benchmarking and market analysis in consultation with Longnecker & Associates. The Company typically makes these annual non-employee director equity grants on October 1 of each year. The restricted stock, which fully vests on the earliest of one year from the date of grant, the termination of the director’s service due to death or disability, or a change in control, has full voting rights and is eligible to receive dividends (if any are paid).

Directors are also eligible to receive special additional compensation when performing services that are determined by the Board to be well above and beyond the normal director service requirements. The Board has not set a compensatory rate for these services, and no fees were paid for this purpose in fiscal 2021.

Corporate Responsibility, Culture & Compliance

Environmental, Social and Governance Matters

CSWI’s Environmental, Social, and Governance (ESG) strategy is based on our belief that long-term stockholder value, sustainable growth, and social responsibility are interrelated. Corporate responsibility lies at the heart of our culture and speaks directly to our core values of Integrity, Respect, Excellence, Stewardship, Citizenship, Accountability and Teamwork. Driven by our executive leadership team, sustainability influences how we operate our business, take care of our people, and serve our customers. Our ESG initiatives are aligned with and inform the long-term strategies of our operating companies and corporate center. Additionally, ESG-related enterprise risks and opportunities are identified and addressed through our strategic processes, helping further align our initiatives and strategy. |

|

Our Board’s proactive engagement and oversight on ESG matters is demonstrated in the following ways:

Our Board and its committees engage at least quarterly with our executive team members having responsibility to present and discuss various ESG topics. In the past year, management has presented to the Board and its committees on initiatives such as business continuity, environmental compliance, employee health and safety, gender pay equity, diversity and inclusion, and employee welfare programs.

Our Audit Committee and Board have direct engagement with ESG risk areas through our robust Enterprise Risk Management (“ERM”) program.

We are committed to being good stewards of the environment. We demonstrate our commitment by actively working to reduce the environmental impact of our operations and by providing environmentally responsible products and services to our customers. Our products help protect and reduce emissions from industrial systems and mission-critical equipment; improve the energy efficiency and resource consumption of HVAC/R, plumbing, and electrical systems; and make commercial and residential buildings safer for occupants and their surrounding communities. Additionally, certain manufacturing facilities within our operating companies are ISO 14001 certified.

In the last year, we have made progress on many environment-focused initiatives, which have included:

Reducing overall energy consumption and increasing the amount of consumed electricity that is generated from renewable sources, such as solar and wind

Reducing the amount of scrap and non-recyclable waste generated by our operations by increasing the use of rework and recycled materials

As we look forward, we are focused on making the environmental initiatives of our various operating companies more coordinated and standardized. This will help us provide more disclosure about these initiatives and align such disclosures with the SASB Industrial Machinery and Goods and Chemicals Reporting Standards.

At CSWI, how we succeed matters. We live out our commitment to doing the right things the right way by first taking care of the health, safety, and wellbeing of our employees—our most valuable asset. We view this duty holistically and address it on multiple fronts, including through competitive total rewards compensation; comprehensive benefits and retirement plans, including employer-funded healthcare coverage and defined contribution benefit plans with profit sharing; health and safety training and programs; and training and development, including job skills and compliance training, leadership training, and advancement opportunities.

Maintained full, performance-managed employment throughout the year, with no COVID-19-related furloughs or layoffs

Provided enhanced programs focused on employee wellness, including paid leave for personal or family COVID-19 illness

Reinvigorated our safety training programs, including the launch of an inaugural Safety Awareness Month with supplemental training

Demonstrating the effectiveness of our safety focus, our Total Recordable Incident Rate (“TRIR”) at the end of calendar 2020 was 3.2, and through the first three months of calendar 2021 (the end of our fiscal year), our TRIR was 1.9. These results represent meaningful improvements year over year.

Notably, in fiscal 2021 we maintained our comprehensive and competitive retirement and benefit programs, despite the challenges presented by the COVID-19 pandemic. Since our inception, we have provided a 100% match of employee contributions up to 6% of compensation to our 401(k) plans, as well as an additional 7% to 11% of eligible compensation each year through profit sharing benefit programs, including our Employee Stock Ownership Plan, which strongly aligns our employees’ interests with those of our stockholders. This equates to 13% to 17% of each employee’s annual eligible compensation that we invest to help provide a safe, secure and dignified retirement for our people. Our commitment to our employees fostered income certainty throughout the past year, eliminating one source of vulnerability for our employees, while contributing positively to employee engagement levels, which we actively monitor.

Sound governance practices are foundational to any high performing organization. We believe the principles and policies described throughout this proxy statement clearly demonstrate our commitment to thoughtful, value-focused governance that helps us effectively manage our enterprise risks and ultimately preserve and create stockholder value.

Our ERM program, which is overseen by our Audit Committee, supports our efforts in this area. Since our inception, our ERM program has begun with an annual risk assessment survey. Near the end of each calendar year, approximately 30 key leaders across our organization receive a focused questionnaire that they use to provide feedback on a universe of enterprise risks covering six distinct risk categories: Strategic; Financial; Legal & Compliance; Operational; IT & Systems; and Talent Management.

In the survey, each risk is evaluated on impact, likelihood of occurrence, and controls effectiveness. The survey results are compiled and calibrated, which produces a prioritized list of inherent and residual enterprise risks. Once these enterprise risk priorities are established, a “dashboard” for each risk is developed that identifies the risk owner, what we are doing to prevent or mitigate the risk, how we can improve our prevention or mitigation efforts, and key risk indicators. This process is completed in our first fiscal quarter of the year, which enables the annual ERM program results to inform and be incorporated into our strategic planning efforts.

Executive Officers

The following sets forth information about the Company’s executive officers. Information for Mr. Armes, who is both Chairman of the Board and an executive officer of the Company, is presented above under “Board of Directors—Biographical Information—Nominees to Serve a Term Expiring at the 2022 Annual Meeting of Stockholders.”

|

Name |

Age |

Year Joined CSWI |

Position With the Company |

In Position Since |

|

Joseph B. Armes |

59 |

2015 |

Chairman, CEO & President |

2015 |

|

James E. Perry |

50 |

2020 |

Executive VP, CFO |

2020 |

|

Donal J. Sullivan |

58 |

2015 |

Executive VP & GM, Industrial Products |

2020 |

|

Luke E. Alverson |

43 |

2016 |

Senior VP, General Counsel and Secretary |

2016 |

James E. Perry has served as Executive Vice President and Chief Financial Officer since June 2020. From 2004 through May 2020, Mr. Perry served in senior financial leadership roles with Trinity Industries, a publicly held, diversified industrial company, including serving as Chief Financial Officer from May 2010 to February 2019. From 2001 to 2004, Mr. Perry served in senior financial leadership roles at RMH Teleservices, a telemarketing and customer service company, including serving as Chief Financial Officer. Mr. Perry began his career at JP Morgan Chase & Co. in the investment banking division, and he also served in a consulting group within Ernst & Young LLP.

Donal J. Sullivan has served as Executive Vice President & General Manager, Industrial Products since May 2020, and previously served as Senior Vice President & General Manager, Industrial Products from January 2016, and was appointed as an executive officer of the Company in March 2019. From May 2015 to January 2016, Mr. Sullivan was the Chief Operating Officer for RectorSeal, one of the Company’s operating subsidiaries. From October 2010 to April 2015, he served as Division President of Goodman Global, a member of the Daikin Group, a leading global HVAC manufacturer. Prior to 2005, Mr. Sullivan held a variety of management positions at Carrier Corporation, a leading heating, air-conditioning and refrigeration solutions company, including sales, product management and general management.

Luke E. Alverson has served as Senior Vice President, General Counsel and Secretary since February 2016. From May 2008 to February 2016, he held roles of increasing responsibility with Flowserve Corporation, a leading global manufacturer of fluid motion control products and provider of related services, serving most recently as Vice President, Corporate Legal Services and Assistant Secretary. Prior to 2008, Mr. Alverson was associated with the law firms of Vinson & Elkins, LLP in Dallas, Texas, and Hallett & Perrin, P.C., in Dallas, Texas.

Proposal Two:

Advisory Vote on Executive Compensation

The Board is providing stockholders the opportunity to cast an advisory vote on the compensation of our Named Executive Officers pursuant to Section 14A of the Securities Exchange Act of 1934. This proposal, commonly known as a “Say on Pay” proposal, gives our stockholders the opportunity to endorse or not endorse our executive compensation programs and policies and the compensation paid to our Named Executive Officers. We currently hold annual “Say on Pay” votes.

The Board values the opinions of the Company’s stockholders as expressed through their votes and other communications. This Say on Pay vote is advisory, meaning that it is not binding on the Compensation Committee or the Board. This vote will not affect any compensation already paid or awarded to any Named Executive Officer, nor will it change any decisions the Board has made. Nonetheless, the Compensation Committee and the Board will review and carefully consider the outcome of this advisory vote when making future decisions regarding our executive compensation programs and policies.

We design our executive compensation programs to implement our core objectives of attracting and retaining key leaders, rewarding current performance, driving future performance, and aligning the long-term interests of our executives with those of our stockholders. Stockholders are encouraged to read the Compensation Discussion & Analysis (“CD&A”) section of this proxy statement, including the “Executive Summary.” In the CD&A, we describe our compensation programs, including the underlying philosophy and strategy, the individual elements of compensation, and how our compensation plans are administered. We also describe how the Compensation Committee continues to evolve our executive compensation program based on stockholder feedback.

We believe stockholders should consider the following financial performance data and compensation design elements when voting on this proposal:

Concerning our annual incentive plan, the consolidated operating income performance metric was 126.5% of plan, resulting in a payout of 152.8% of target for that metric, and the operating cash flow performance metric was 154.4% of plan, resulting in a payout of 150.0% of target for that metric. Combined, this resulted in a weighted average financial performance metric payout of 152% of target for the consolidated CSWI metrics.

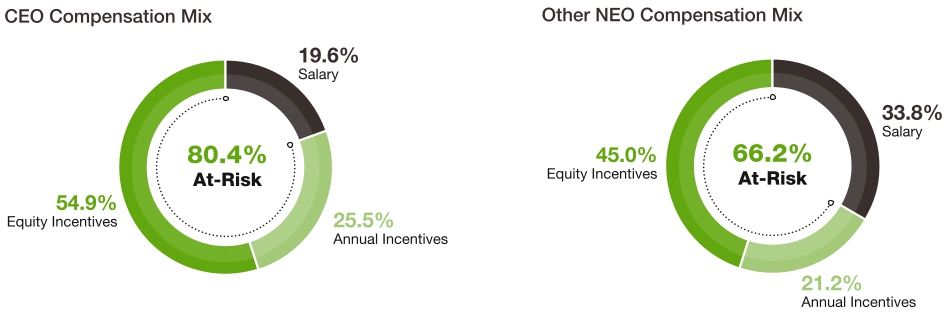

On average, the Named Executive Officers had 72.2% (or 80.4% in the case of the CEO) of their target pay “at risk,” or dependent upon both Company and individual performance.

Maximum payout levels for the annual cash incentive award are capped at 200% of target, with formulaic positive or negative adjustment for financial and individual performance, and the performance share award payouts are capped at 200% of target. These caps moderate total compensation amounts and reduce the incentive to engage in unnecessarily risky behavior.

The annual cash incentive award and the performance share award have threshold performance requirements, ensuring that incentive compensation is reduced or eliminated altogether if minimum performance levels are not achieved.

Our officers are subject to stock ownership guidelines, which further encourage a long-term focus on sustainable performance and align our officers’ interests with those of our stockholders.

Our officers are prohibited from pledging Company stock or engaging in transactions designed to hedge the value of the Company’s stock.

Our officers, along with all of our U.S. employees, participate in our Employee Stock Ownership Plan, through which over 4% of our Company is owned by our employees, serving to align our collective interests.

The Company does not provide perquisites to executive officers, other than those generally provided to all employees.

The Board believes the Company’s executive compensation programs use appropriate structures and sound pay practices promoting our core objectives. Further, the Board and the Compensation Committee took into account the results of the 2020 Say on Pay vote and other stockholder feedback and continued to evaluate the Company’s compensation practices for fiscal 2021. For additional information, see “— Executive Summary — Executive Compensation Program Changes for Fiscal 2021” within the CD&A on page 32.

This analysis and consideration also supported the Board’s decision to provide Mr. Armes with a special equity grant in early fiscal 2022 focused on retaining Mr. Armes through retirement and ensuring successful succession planning practices for the Chief Executive Officer role. This long-term incentive award will be included in the summary compensation table in the proxy statement for the 2022 annual meeting of stockholders. For additional information, see “— Retention and Succession Arrangement with Mr. Armes” within the CD&A on page 46.

Required Vote and Recommendation

Approval of this proposal will require the affirmative vote of a majority of the votes cast in person or represented by proxy. The individuals named as proxies on the enclosed proxy card will vote your proxy “FOR” this proposal unless you instruct otherwise or you withhold authority to vote. For more information, see “General Voting and Meeting Information—Voting—Counting of Votes.”

The advisory vote on executive compensation is non-binding, meaning that our Board will not be obligated to take any compensation actions, or to adjust our executive compensation programs or policies, as a result of the vote. However, our Compensation & Talent Development Committee considers the results of the vote in evaluating our executive compensation program.

Compensation & Talent Development Committee Report

The Compensation Committee is currently made up of four independent directors: Linda Livingstone (Chair), Michael Gambrell, William Quinn and Kent Sweezey.

The Compensation Committee has reviewed and discussed with management the following Compensation Discussion and Analysis. Based on this review and discussion, the Compensation Committee recommended to the Board of Directors that this Compensation Discussion and Analysis be included in this proxy statement and incorporated by reference in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission for the fiscal year ended March 31, 2021.

Compensation Discussion and Analysis

Executive Summary

This Compensation Discussion and Analysis (“CD&A”) contains an overview and analysis of our executive compensation program and policies and the material compensation decisions we have made for the executive officers named in the “Summary Compensation Table” on page 48. We refer to this group of executive officers collectively as our “Named Executive Officers” throughout this document. During fiscal 2021, our Named Executive Officers were:

|

|

Joseph B. Armes |

Chairman, Chief Executive Officer (“CEO”) and President (principal executive officer) |

James E. Perry |

Executive Vice President and Chief Financial Officer (“CFO”) (principal financial officer) |

Donal J. Sullivan |

Executive Vice President and General Manager, Industrial Products |

Craig J. Foster |

Former Senior Vice President and General Manager, Specialty Chemicals(1) |

Luke E. Alverson |

Senior Vice President, General Counsel & Secretary |

Gregg W. Branning |

Former Executive Vice President and CFO(2) |

|

(1)

Mr. Foster’s employment with the Company ended in May 2021, after fiscal year end. (2)

Mr. Branning’s employment with the Company ended in May 2020. |

|

At last year’s annual meeting, we conducted an advisory vote to approve our Named Executive Officers’ compensation for fiscal 2020. A significant majority (95.6%) of the votes cast in the executive compensation vote were voted in favor of the compensation of our Named Executive Officers. While the Say on Pay vote is nonbinding, the Compensation Committee believes this level of approval indicates that our stockholders strongly support our executive compensation program and policies and the material compensation decisions made for executive officers. The Compensation Committee will consider the results of this year’s say-on-pay proposal, as well as continuing feedback from our stockholders, when evaluating future executive compensation decisions. |

|

Fiscal 2021 began with the opportunity to continue building momentum on our outstanding fiscal 2020 performance. However, global events, including the COVID-19 pandemic and resulting economic crisis, challenged the executive team in multiple unprecedented ways. Despite these challenges, Mr. Armes and the CSWI executive team led the Company well, successfully adapting to rapidly changing business, economic, and social conditions, completing the Company’s largest acquisition to date, and, ultimately, delivering impressive financial results.

The following highlights our consolidated financial results achieved in fiscal 2021 (comparisons to fiscal 2020).

Just after year end formed a joint venture with Shell/Pennzoil Quaker State to drive organic growth for greases and lubricants

Maintained full, performance-managed employment throughout the year, with no COVID-19-related furloughs or layoffs

Advanced our health and safety program, including completing an inaugural Safety Awareness Month, resulting in meaningful decreases in our TRIR

As discussed in more detail under “—Elements of the Executive Compensation Program—Annual Incentive Program,” our Named Executive Officers are eligible to receive a cash incentive payment based upon the Company’s annual financial performance against pre-established goals. Based on our fiscal 2021 results, the Company achieved 126.5% of our aggregate quarterly Operating Income goals and achieved 154.4% of our annual Operating Cash Flow goal.

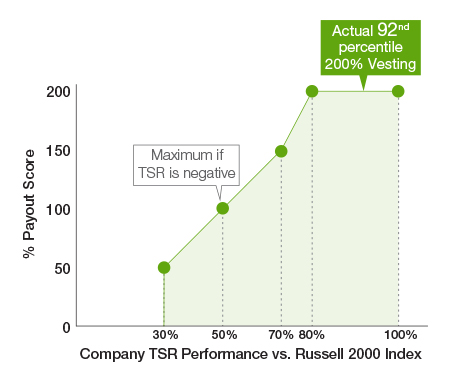

As discussed in more detail under “—Elements of the Executive Compensation Program—Long Term Incentives,” our Named Executive Officers, as well as other Company employees, are eligible to receive equity awards that vest based upon the Company’s financial performance against pre-established goals. For the April 1, 2018 to March 31, 2021 performance period, our Named Executive Officers at the time received performance shares that vested based on the Company’s TSR compared to the TSR of the Russell 2000 Index’s members. When measured as prescribed in our performance share awards, the Company achieved a TSR of 190.8% for this performance period, which ranked 169th among the 2,023 members of the Russell 2000 Index, or the 92nd percentile, vesting these performance shares at 200% of target as shown in the chart to the right. This result is consistent with our emphasis on long-term stockholder value creation and the achievement of benchmarked performance goals, which are described in more detail throughout this CD&A.

As shown below, for fiscal 2021, our CEO had 80.4% of his target pay “at risk,” or dependent upon the Company’s and his individual performance, and our other Named Executive Officers had on average 66.2% of their target pay “at risk.”

The Compensation Committee has designed our executive compensation program to support CSWI’s growth strategy. Our key executive compensation objectives are:

In furtherance of these objectives, the Compensation Committee maintains a thoughtful approach to our executive compensation program design and governance practices. The below table summarizes these practices.

What We Do |

|

What We Don’t Do |

||

|

Promote a strong pay for performance plan design |

|

|

No hedging, pledging, or short sales of stock permitted |

|

Regularly benchmark executive compensation against peers of comparable size, complexity, and industry |

|

|

No change in control excise tax gross-ups |

|

Maintain meaningful stock ownership guidelines for our directors and executive officers |

|

|

No option repricing without stockholder approval |

|

Have double trigger requirements on cash payments following a change in control |

|

|

No perquisites offered, other than those generally provided to all employees |

|

Conduct an annual compensation risk review |

|

|

No dividends paid and no voting rights on unvested performance-based equity awards |

|

Provide reasonable and standardized benefits upon severance or change in control |

|

|

No duplication of metrics in annual and long-term incentive plans |

|

Engage an independent compensation consultant |

|

|

No supplemental executive retirement plans |

|

Maintain an incentive compensation “clawback” policy |

|

||

Annual Executive Compensation Program Review and Compensation Risk

It is the Compensation Committee’s policy to regularly monitor and annually review our executive compensation program to determine, in consultation with Longnecker, whether the elements of the program are consistent with our stated executive compensation objectives and principles. Part of this review is an evaluation of whether the executive compensation program and our compensation programs as a whole are consistent with the Company’s risk management objectives. If the elements of the program are determined to be inconsistent with our objectives and principles, or if any incentives are determined to encourage risks that are reasonably likely to have a material adverse effect on us, the elements are adjusted as necessary.

The Compensation Committee, in consultation with Longnecker, has concluded that no risks arising from our compensation policies and practices are reasonably likely to have a material adverse effect on the Company. In reaching this conclusion, the Compensation Committee noted that:

Compensation elements are balanced. Our compensation program design provides a balanced mix of base salary, annual cash incentive compensation and, for eligible employees, long-term equity incentives. This balanced mix provides executives with the incentive to perform at high levels and maximize Company performance. At the same time, it does not encourage singular focus on compensation performance metrics to the detriment of other important business metrics or the way in which goals are accomplished.

Metrics balance short-term and long-term goals. Our incentive compensation metrics are balanced between short- and long-term business and financial objectives. The metrics for our short- and long-term plans do not overlap, which prevents executives from focusing too much attention on one goal to the exclusion of others. All of the performance goals are aligned with stockholder interests.

Individual performance is emphasized. We emphasize individual, non-financial performance metrics in determining final individual compensation amounts. The Compensation Committee strongly believes this component of our program offers an effective way to encourage and reward behaviors that are consistent with our business objectives and core values.

Incentive programs have performance thresholds and are capped. Both the AIP opportunity and performance share awards have threshold payout levels and/or performance contingencies, which ensure that incentive compensation is reduced or eliminated altogether if minimum performance levels are not achieved. They also have maximum payout levels, which helps avoid excessive total compensation and reduces the incentive to engage in unnecessarily risky behavior.

Compensation is benchmarked. The Compensation Committee benchmarks compensation against both our peer group and the broader market to ensure our compensation programs are performance-based, competitive, equitable, and generally consistent with industry and comparator company practices.

Executives have ownership guidelines. Our officers have equity ownership guidelines, which further encourage a long-term focus on sustainable performance and further align our officers’ interests with those of our stockholders. Additionally, officers are prohibited from pledging stock and engaging in transactions designed to hedge against the value of the Company’s stock.

Summary Compensation Table

The following table sets forth compensation information for our Named Executive Officers — the individuals who served during fiscal 2020 as principal executive officer and principal financial officer of the Company, and the other most highly compensated executive officers of the Company serving at the end of fiscal 2021.

Name and Principal Position |

Year |

(1) |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

(2) |

Non-Equity Incentive Plan Compensation ($) |

(3) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(4) |

All Other Compensation ($) |

(5) |

Total ($) |

Joseph B. Armes Chairman, CEO and |

2021 |

|

580,672 |

— |

1,775,967 |

(6) |

1,200,000 |

|

4,664 |

61,861 |

|

3,623,164 |

2020 |

|

580,672 |

— |

2,094,452 |

|

1,073,808 |

|

1,286 |

68,258 |

|

3,818,476 |

|

2019 |

|

540,160 |

— |

1,953,721 |

|

1,017,121 |

|

6,849 |

67,238 |

|

3,585,089 |

|

James E. Perry(7) Executive VP, CFO |

2021 |

|

311,077 |

— |

873,821 |

(8) |

400,000 |

|

— |

30,062 |

|

1,614,960 |

Donal J. Sullivan Executive VP, GM, |

2021 |

|

366,593 |

52,470 |

583,908 |

(9) |

347,530 |

|

— |

58,216 |

|

1,408,717 |

2020 |

|

366,593 |

— |

494,173 |

|

317,943 |

|

— |

69,139 |

|

1,247,848 |

|

2019 |

|

344,850 |

— |

267,041 |

|

258,741 |

|

— |

76,228 |

|

946,860 |

|

Craig J. Foster(10) Former Senior VP, GM, Specialty Chemicals |

2021 |

|

331,660 |

— |

319,110 |

(11) |

177,465 |

|

— |

58,946 |

|

887,181 |

2020 |

|

331,660 |

— |

389,653 |

|

251,232 |

|

— |

69,999 |

|

1,042,544 |

|

2019 |

|

322,000 |

— |

309,326 |

|

352,628 |

|

— |

67,968 |

|

1,051,922 |

|

Luke E. Alverson Senior VP, General Counsel and Secretary |

2021 |

|

299,601 |

— |

327,317 |

(12) |

250,000 |

|

— |

60,546 |

|

937,464 |

2020 |

|

299,601 |

— |

351,980 |

|

234,401 |

|

— |

69,394 |

|

955,376 |

|

2019 |

|

290,875 |

— |

288,407 |

|

215,175 |

|

— |

67,794 |

|

862,251 |

|

Gregg W. Branning(13) Former Executive VP, CFO |

2021 |

|

89,071 |

— |

— |

|

— |

|

— |

510,846 |

|

599,917 |

2020 |

|

425,000 |

— |

609,675 |

|

433,500 |

|

— |

62,890 |

|

1,531,065 |

|

2019 |

|

350,000 |

— |

475,619 |

|

428,719 |

|

— |

63,642 |

|

1,317,980 |

|

(1)

The Company’s fiscal year begins April 1 and ends March 31. (2)

Represents the grant date fair value of long-term equity incentive awards under the Company’s LTIP computed in accordance with FASB ASC 718 “Compensation — Stock Compensation,” including the impact of forfeitures. The incentive awards are granted in the form of restricted stock, which generally vest ratably over a three-year period, and performance shares. The performance criteria for the performance share awards is based on the Company’s TSR over a three-year period compared to the TSR of the Company’s applicable benchmark group for the same period, as described in further detail under “—Elements of the Executive Compensation Program—Long-Term Incentives—Performance Share Awards” above. The reported value of the performance unit awards is computed based on the probable outcome of the performance conditions based on a Monte Carlo simulation and the grant date estimate of compensation cost to be recognized over the performance period, which was 126% of target, or $74.26 per share. Payout for the performance share awards can range from 0% to a maximum of 200%. Assumptions used in the valuations are discussed in Note 6 to the Company’s audited consolidated financial statements for the year ended March 31, 2021, in the Annual Report. (3)

The amounts in this column include an annual cash incentive bonus for fiscal 2021 under the Company’s AIP that was earned in fiscal 2021 but paid in fiscal 2022. (4)

Reflects the annualized increase in pension value under the Restoration Plan. See “Pension Benefits Table.” There are no above-market or preferential earnings on compensation deferred under the Restoration Plan. (5)

The components of this column for fiscal 2021 are set forth in the table below, calculated at the aggregate incremental cost to the Company: |

||||||||||||

Name |

Retirement Plan Contributions |

(A) |

ESOP Contributions |

(B) |

Insurance Premiums |

(C) |

Severance Amounts |

(D) |

Total |

Joseph B. Armes |

22,891 |

|

14,250 |

|

24,720 |

|

– |

|

61,861 |

James E. Perry |

14,400 |

|

– |

|

15,662 |

|

– |

|

30,062 |

Donal J. Sullivan |

21,954 |

|

14,250 |

|

22,012 |

|

– |

|

58,216 |

Craig J. Foster |

22,035 |

|

14,250 |

|

22,661 |

|

– |

|

58,946 |

Luke E. Alverson |

22,800 |

|

14,250 |

|

23,496 |

|

– |

|

60,546 |

Gregg W. Branning |

10,467 |

|

– |

|

3,129 |

|

497,250 |

|

510,846 |

|

(A)

Includes matching and discretionary Company contributions to the Named Executive Officers under the Company’s 401(k) retirement plan, which is generally available to all the Company’s U.S. employees. |

|||||||||

|

(B)

Includes Company contributions to the Employee Stock Ownership Plan for fiscal 2021, which is generally available to all the Company’s U.S. employees. These amounts were accrued in fiscal 2021 but contributed in fiscal 2022. (C)

Includes annual premiums for group term life insurance, the Company’s portion of annual premiums for medical, dental and vision benefits and the Company’s portion of disability premiums. (D)

Includes the value of cash severance amounts paid to Mr. Branning under the CIC and Severance plan upon his termination on May 31, 2020. |

|||||||||

(6)

Includes annual grants of 11,074 shares of restricted stock ($860,118) and 12,333 shares of performance units ($915,849) made under the Company’s LTIP. Restricted stock award values were calculated using a price per share of $77.67, the closing market price of the Company’s common stock as reported by NASDAQ on October 1, 2020, the date of grant. Performance unit award values were calculated using a fair value of $74.26 per share as determined by the Monte Carlo simulation. The maximum potential value of the performance units at grant date, assuming the highest level of performance conditions, was $1,625,882. |

||||||||||

(7)

Mr. Perry joined the Company on May 20, 2020. (8)

Includes annual grants of 4,291 shares of restricted stock ($333,282) and 4,779 shares of performance units ($354,889) made under the Company’s LTIP. Also includes a one-time grant of 2,500 shares of performance units ($185,650) made at commencement of employment. Restricted stock award values were calculated using a price per share of $77.67, the closing market price of the Company’s common stock as reported by NASDAQ on October 1, 2020, the date of grant. Performance unit award values were calculated using a fair value of $74.26 per share as determined by the Monte Carlo simulation. The maximum potential value of the performance units at grant date, assuming the highest level of performance conditions, was $858,049. (9)

Includes annual grants of 3,746 shares of restricted stock ($290,952) and 3,945 shares of performance units ($292,956) made under the Company’s LTIP. Restricted stock award values were calculated using a price per share of $77.67, the closing market price of the Company’s common stock as reported by NASDAQ on October 1, 2020, the date of grant. Performance unit award values were calculated using a fair value of $74.26 per share as determined by the Monte Carlo simulation. The maximum potential value of the performance units at grant date, assuming the highest level of performance conditions, was $465,037. (10)

Mr. Foster’s employment with the Company ended on May 31, 2021. (11)

Includes annual grants of 1,703 shares of restricted stock ($132,272) and 2,516 shares of performance units ($186,838) made under the Company’s LTIP. Restricted stock award values were calculated using a price per share of $77.67, the closing market price of the Company’s common stock as reported by NASDAQ on October 1, 2020, the date of grant. Performance unit award values were calculated using a fair value of $74.26 per share as determined by the Monte Carlo simulation. The maximum potential value of the performance units at grant date, assuming the highest level of performance conditions, was $331,660. 1,135 shares of the restricted stock grant and all of the granted performance units were forfeited upon Mr. Foster’s termination on May 31, 2021. (12)

Includes annual grants of 2,041 shares of restricted stock ($158,524) and 2,273 shares of performance units ($168,793) made under the Company’s LTIP. Restricted stock award values were calculated using a price per share of $77.67, the closing market price of the Company’s common stock as reported by NASDAQ on October 1, 2020, the date of grant. Performance unit award values were calculated using a fair value of $74.26 per share as determined by the Monte Carlo simulation. The maximum potential value of the performance units at grant date, assuming the highest level of performance conditions, was $299,602. (13)

Mr. Branning’s employment with the Company ended on May 31, 2020. |

||||||||||

2021 Grants of Plan-Based Awards

The following table sets forth certain information with respect to plan-based awards granted to the Named Executive Officers for the year ended March 31, 2021.

Name |

Grant Date |

|

Estimated Future Payouts Under Non-Equity Incentive Plan Awards |

|

Estimated Future Payouts Under Equity Incentive Plan Awards(1) |

|

All Other Stock Awards: Number of Shares of Stock or Units (#) |

|

Grant Date Fair Value of Stock and Option Awards ($) |

(2) |

||||

Threshold ($) |

Target ($) |

Maximum ($) |

Threshold (#) |

Target (#) |

Maximum (#) |

|||||||||

Joseph B. Armes |

5/11/2020 |

(3) |

377,437 |

754,874 |

1,509,748 |

|

|

|

|

|

|

|

|

|

4/1/2020 |

|

|

|

|

|

6,167 |

12,333 |

24,666 |

|

|

|

915,849 |

(4) |

|

10/1/2020 |

|

|

|

|

|

|

|

|

|

11,074 |

(5) |

860,118 |

|

|

James E. Perry |

5/20/2020 |

(3) |

135,000 |

270,000 |

540,000 |

|

|

|

|

|

|

|

|

|

5/20/2020 |

|

|

|

|

|

3,640 |

7,279 |

14,558 |

|

|

|

540,539 |

(4) |

|

10/1/2020 |

|

|

|

|

|

|

|

|

|

4,291 |

(5) |

333,282 |

|

|

Donal J. Sullivan |

5/11/2020 |

(3) |

109,978 |

219,956 |

439,912 |

|

|

|

|

|

|

|

|

|

4/1/2020 |

|

|

|

|

|

1,973 |

3,945 |

7,890 |

|

|

|

292,956 |

(4) |

|

10/1/2020 |

|

|

|

|

|

|

|

|

|

3,746 |

(5) |

290,952 |

|

|

Craig J. Foster |

5/11/2020 |

(3) |

99,498 |

198,996 |

397,992 |

|

|

|

|

|

|

|

|

|

4/1/2020 |

|

|

|

|

|

1,258 |

2,516 |

5,032 |

|

|

|

186,838 |

(4) |

|

10/1/2020 |

|

|

|

|

|

|

|

|

|

1,703 |

(5) |

132,272 |

|

|

Luke E. Alverson |

5/11/2020 |

(3) |

82,391 |

164,781 |

329,562 |

|

|

|

|

|

|

|

|

|

4/1/2020 |

|

|

|

|

|

1,137 |

2,273 |

4,546 |

|

|

|

168,793 |

(4) |

|

10/1/2020 |

|

|

|

|

|

|

|

|

|

2,041 |

(5) |

158,524 |

|

|

|

(1)

The number of shares listed represents long-term equity incentive awards in the form of performance shares under the Company’s LTIP. The performance criteria for these awards is based on the Company’s TSR from April 1, 2020 through March 31, 2023 compared to the TSR performance of the members of the Russell 2000 Index for the same period, as described in further detail under “—Elements of the Executive Compensation Program—Long-Term Incentives—Performance Share Awards” above. (2)

These amounts represent the fair value, as determined under FASB ASC Topic 718, of the awards based on the grant date fair value estimated by the Company for financial reporting purposes. (3)

Under the AIP, the primary performance measures are internally defined metrics based on operating income, cash flow from operations, and achievement of individual performance objectives. See “Elements of the Executive Compensation Program—Annual Incentive Program” above. Actual amounts payable under the AIP, if any, can range from 50% (Threshold) to 200% (Maximum) of the target amounts for the Named Executive Officers based upon the extent to which performance under the foregoing criteria meets, exceeds or is below the target. Actual weighted average payout for the consolidated operating income and operating cash flow metrics (together representing 75% of total AIP) in fiscal 2021 was 152.2% of the target amount. Different business unit metrics were used in the AIP programs for Mr. Sullivan and Mr. Foster, in addition to the consolidated operating income and operating cash flow metrics for the Company. (4)

Represents the fair value on the date of grant, as described in footnote (2), of the performance units awarded, which values were calculated using a fair value of $74.26 per share determined by using the Monte Carlo simulation. The actual value may be more or less depending on the Company’s TSR performance during the applicable three-year performance period. (5)

The amounts shown reflect the numbers of shares of restricted stock granted to each Named Executive Officer pursuant to the Company’s 2015 Equity and Incentive Compensation Plan. The shares vest ratably over a three-year period on each anniversary of the date of grant. |

||||||||||||||

Outstanding Equity Awards at Year-End 2021

The following table sets forth certain information with respect to outstanding equity awards held by the Named Executive Officers as of March 31, 2021.

Name |

Option Awards(1) |

|

Stock Awards |

|

|||||||||

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units of Stock that Have Not Vested (#) |

Market Value of Shares or Units of Stock that Have Not Vested ($) |

(2) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that Have Not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights that Have Not Vested ($) |

(2) |

||||

Joseph B. Armes |

63,413 |

— |

25.23 |

8/28/2024 |

|

27,694 |

(3) |

3,738,690 |

|

15,554 |

(4) |

4,199,580 |

|

|

|

|

|

|

|

|

|

|

13,373 |

(5) |

3,610,710 |

|

|

|

|

|

|

|

|

|

|

|

12,333 |

(6) |

3,329,910 |

|

|

James E. Perry |

— |

— |

— |

— |

|

4,291 |

(7) |

579,285 |

|

7,279 |

(6) |

1,965,310 |

|

Donal J. Sullivan |

— |

— |

— |

— |

|

7,142 |

(8) |

964,170 |

|

2,147 |

(4) |

579,690 |

|

|

|

|

|

|

|

|

|

|

3,006 |

(5) |

811,620 |

|

|

|

|

|

|

|

|

|

|

|

3,945 |

(6) |

1,065,150 |

|

|

Craig J. Foster |

— |

— |

— |

— |

|

2,112 |

(9) |

285,120 |

|

3,207 |

(4) |

865,890 |

|

Luke E. Alverson |

— |

— |

— |

— |

|

4,275 |

(10) |

577,125 |

|

2,750 |

(4) |

742,500 |

|

|

|

|

|

|

|

|

|

|

2,572 |

(5) |

694,440 |

|

|

|

|

|

|

|

|

|

|

|

2,273 |

(6) |

613,710 |

|

|

Gregg W. Branning |

— |

— |

— |

— |

|

— |

|

— |

|

4,433 |

(4) |

1,196,910 |

|

(1)

All option awards shown in this table represent stock options issued in conversion of CSWC stock option awards granted prior to the Spin-Off. The stock option issuances converted existing CSWC stock option awards consistent with the treatment of shares in the Spin-Off. (2)

Calculated using a price per share of $135.00, the closing market price of the Company’s common stock as reported by NASDAQ on March 31, 2021, the last trading day before the end of the Company’s last completed fiscal year. (3)

Mr. Armes’ shares of restricted stock vest as follows: 15,207 shares on October 1, 2021; 8,796 shares on October 1, 2022; and 3,691shares on October 1, 2023. (4)

These shares represent long-term equity incentive awards in the form of performance shares under the Company’s LTIP. The performance measure set for this plan was based on the Company’s TSR over the period from April 1, 2018 through March 31, 2021 compared to the TSRs of the members of the Russell 2000 Index for the same period. Payouts ranged from 0% to a maximum of 200% of the shares granted. The number of shares reported vested at 200% of target effective April 1, 2021, and the associated value reported reflects this vesting percentage. (5)

These shares represent long-term equity incentive awards in the form of performance shares under the Company’s LTIP. The performance measure set for this plan is based on the Company’s TSR over the period from April 1, 2019 through March 31, 2022 compared to the TSRs of the members of the Russell 2000 Index for the same period. Payouts can range from 0% to a maximum of 200% of the shares granted. The reported value associated with the shares assumes vesting at 200%. (6)

These shares represent long-term equity incentive awards in the form of performance shares under the Company’s LTIP. The performance measure set for this plan is based on the Company’s TSR over the period from April 1, 2020 through March 31, 2023 compared to the TSRs of the members of the Russell 2000 Index for the same period. Payouts can range from 0% to a maximum of 200% of the shares granted. The reported value associated with the shares assumes vesting at 200%. (7)

Mr. Perry’s shares of restricted stock vest as follows: 1,431 shares on October 1, 2021; 1,430 shares on October 1, 2022; and 1,430 shares on October 1, 2023. (8)

Mr. Sullivan’s shares of restricted stock vest as follows: 3,387 shares on October 1, 2021; 2,512 shares on October 1, 2022; and 1,249 shares on (9)

In connection with Mr. Foster’s departure from the Company in May 2021, and pursuant to the terms of the Company’s Executive CIC and Severance Benefit Plan, 2,112 shares of restricted stock that were scheduled to vest on October 1, 2021 vested immediately. The remaining restricted shares were forfeited. (10)

Mr. Alverson’s shares of restricted stock vest as follows: 2,186 shares on October 1, 2021; 1,409 shares on October 1, 2022; and 680 shares on |

|||||||||||||

2021 Option Exercises and Stock Vested

The following table sets forth certain information with respect to stock option exercises and restricted stock vesting during the fiscal year ended March 31, 2021, with respect to the Named Executive Officers.

Name |

Option Awards |

|

Stock Awards |

||||

Number of Shares Acquired on Exercise (#) |

|

Value Realized on Exercise ($) |

Number of Shares Acquired on Vesting (#) |

(1) |

Value Realized on Vesting ($)(2) |

||

Joseph B. Armes |

52,445 |

|

2,505,298 |

|

56,555 |

|

3,677,317 |

James E. Perry |

— |

|

— |

|

— |

|

— |

Donal J. Sullivan |

— |

|

— |

|

9,877 |

|

656,250 |

Craig J. Foster |

— |

|

— |

|

6,129 |

|