Our Fiscal 2021 Performance

As we began fiscal 2021 amid the backdrop of the COVID-19 pandemic, a global recessionary environment and significant uncertainty within our served end markets, we articulated four guiding objectives: treating our employees well; serving our customers well; effectively managing our supply chains; and positioning the Company for sustainable, long-term success. With these objectives in mind, we began fiscal 2021 well positioned to successfully navigate near-term uncertainty with singular focus on emerging as an even stronger company.

I am proud to report that fiscal 2021 was, by many measures, our best year on record. Our achievements were enabled by the strength of our diversified business model, our team’s tireless work and dedication, and our continued strategic and disciplined allocation of capital. Not only did our sustainable business model demonstrate its strength and resilience, but with the support of our strong balance sheet, we executed on all aspects of our capital allocation strategy, including:

| • | Investing in inorganic growth, including the $360 million acquisition of TRUaire and its leading portfolio of grilles, registers and diffusers for HVAC systems in December 2020; |

| • | Returning $15.4 million to stockholders through dividends and share repurchases; and |

| • | Investing $8.8 million in capital expenditures and forming the Shell & Whitmore Reliability Solutions joint venture just after the end of the fiscal year, all focused on fueling organic growth. |

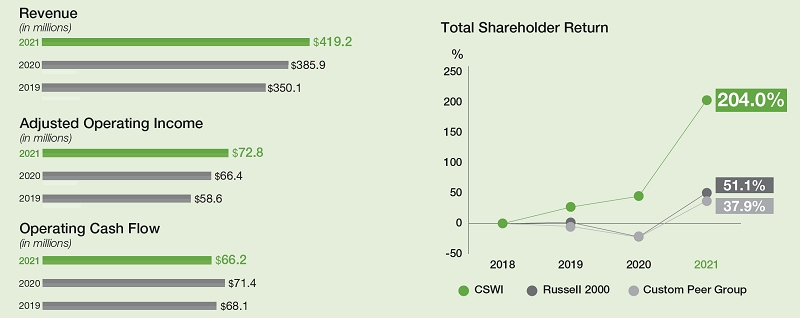

All these actions ultimately translated into impressive financial results, despite the unique challenges of the last year. Consolidated revenue from continuing operations increased 8.6% to $419.2 million. Adjusted operating income increased 9.6% to $72.8 million.

Adjusted net earnings from continuing operations were $51.0 million, or $3.37 per share, an increase of 5.3% on adjusted earnings per share from the prior year. All of this translated to impressive returns for our shareholders, with a total shareholder return of over 109% in fiscal 2021, and a total shareholder return of 204% over the last three years, as compared to Russell 2000 Index returns of 93.4% and 51.1%, respectively.

Throughout the year, our team continued to demonstrate a commitment to maintaining a conservative financial position, including a strong resilient balance sheet, ongoing access to capital, and ample liquidity. We ended fiscal 2021 with $10.1 million of cash on hand and delivered cash flow from operations of $66.3 million, even with the one-time transaction costs associated with growth investments during the year. Additionally, at year end our pro forma leverage ratio was 1.9x, and shortly after year end, we executed a new $400 million, five-year revolving credit facility to ensure continued ample liquidity. These actions further strengthened our balance sheet and provided ready access to capital for future growth opportunities.

Culture and Corporate Responsibility

For many years, I have emphasized our steadfast commitment to our employee-centric culture where we recognize that our talented employees are our most valuable asset and believe that our skilled, engaged workforce represents a true competitive advantage. Corporate responsibility lies at the heart of our culture and speaks directly to our core values of Integrity, Respect, Excellence, Stewardship, Citizenship, Accountability and Teamwork. Driven by our executive leadership team, sustainability influences how we operate our business, take care of our people, and serve our customers.

At CSWI, how we succeed matters. We live out our commitment to doing the right things the right way by first taking care of the health, safety, and wellbeing of our employees. We are committed to creating and maintaining a safe, heathy working environment, and we have developed a health and safety program that focuses on ensuring our employees understand this commitment.

This year underscored for us the importance of keeping our employees safe and healthy. In response to the pandemic, we developed a business continuity plan that was aligned with guidance from the World Health Organization and the Centers for Disease Control and Prevention to protect the health and safety of our workforce and enable us to continue to serve our customers. Supported by these efforts, all our production sites maintained operations throughout the pandemic with minimal disruption. To enable this business continuity, we mobilized nearly 100% of our non-manufacturing employees to remote work or flexible work arrangements; strengthened programs focused on employee wellness, including paid leave for personal or family illness; and limited non-essential travel.

We are most proud of the fact that we had zero pandemic-related furloughs, layoffs or reductions in force in fiscal 2021. Despite short-term pandemic driven demand degradation in some of our end markets, this commitment to our employees enabled us to retain important institutional knowledge and experience, increase business continuity, and bolster employee retention. Additionally, we are proud to have maintained our comprehensive and competitive retirement, benefit, and profit sharing plans without interruption, including our Employee Stock Ownership Plan, through which our employees collectively own over 4% of CSWI, strongly aligning CSWI’s employees’ interests with the interests of our stockholders.

Looking Forward

Our team delivered tremendous financial performance in a very challenging fiscal 2021 through disciplined and strategic execution, which leaves us well positioned for continued success and sustainable long-term growth. We remain focused on continuing to drive growth in excess of the end markets we serve as well as building on favorable market trends and delivering on our commitments to our employees, customers, and stockholders.

The four guiding objectives with which we began fiscal 2021 will continue to serve us well into the 2022 fiscal year. We believe that continuing to focus first on treating our employees well will serve as the foundation and catalyst for success. Moreover, it enables achievement of the other objectives, as our second guiding objective of serving our customers well – and realizing the organic growth benefits that come from positive, long-term relationships — cannot happen without an engaged, fulfilled workforce.

Acknowledging that external factors such as supply chain challenges and cost inflation could moderate the positive effects of anticipated improvement in market conditions, our third guiding objective keeps us focused on the ongoing need to manage our supply chains well. The strength of our balance sheet and financial position enables us to strategically anticipate supply chain challenges and proactively address them. As we execute on these guiding objectives, we will continue to invest in financially and strategically attractive growth, thus addressing our fourth guiding objective—positioning the company for sustainable, long-term success.

In closing, I would like to recognize my fellow CSW Industrials Board member, William Quinn, who will be retiring from our Board at the 2021 Annual Meeting. Mr. Quinn was one of five original Board members when we became an independent public company in September 2015 and has contributed meaningfully to making CSW Industrials the company it is today. I know you will join me in thanking Mr. Quinn for his years of distinguished service to the Company and the important leadership role he has played in our collective success.

Item 1: Business

General

CSWI is a diversified industrial growth company with well-established, scalable platforms and domain expertise across two business segments: Industrial Products and Specialty Chemicals. Our broad portfolio of leading products provides performance optimizing and life safety solutions to our customers. Our products include mechanical products for heating, ventilation, air conditioning and refrigeration (“HVAC/R”), grilles, registers and diffusers, building safety solutions and high-performance specialty lubricants and sealants. End markets that we serve include HVAC/R, architecturally-specified building products, plumbing, energy, rail, mining and general industrial. Our manufacturing operations are concentrated in the United States (“U.S.”), Canada and Vietnam, and we have distribution operations in the U.S., Australia, Canada and the United Kingdom (“U.K.”). Our products are sold directly to end users or through designated channels in over 100 countries around the world, including: Australia, Belgium, Brazil, Canada, China, Colombia, Germany, Japan, the Netherlands, Russia, Saudi Arabia, Singapore, South Africa, Sweden, the U.K., United Arab Emirates and the U.S.

Drawing on our innovative and proven technologies, we seek to deliver solutions primarily to our professional end-use customers that place a premium on superior performance and reliability. We believe our industrial brands are well-known in the specific end markets we serve and have a reputation for high quality. We rely on both organic growth and inorganic growth through acquisitions to provide an increasingly broad portfolio of performance optimizing solutions that meet our customers’ ever-changing needs. We have a successful record of making attractive, synergistic acquisitions in support of this objective, and we remain focused on identifying additional acquisition opportunities in our core end markets.

Through our operating companies, we have a well-established legacy of providing high quality products accompanied by dependable service and attention to customer satisfaction. For example, our specialty lubricants were used on the excavation equipment for the Panama Canal. We also have a long history of innovation, and as an example, we believe that we were the pioneers of the acid neutralizer market, being the first to develop a method for removing internal acid from air conditioning and refrigeration systems. We partner with our customers to solve specific challenges and have developed a robust line of chemical and mechanical products. These products are distributed through an extensive wholesale distribution network serving the plumbing, industrial, HVAC/R, construction, electrical, and hardware market places. Many of our products have built a strong following among contractors due to their differentiated performance and from being the first to tackle challenges faced by the professional trades.

CSWI is a Delaware corporation and was incorporated in 2014 in anticipation of CSWI’s separation from Capital Southwest Corporation (“Capital Southwest”); however, our history dates back many decades through our well-established operating companies. The separation was executed on September 30, 2015 through a pro-rata share distribution of all the then outstanding shares of common stock of CSWI to the holders of common stock of Capital Southwest (the “Share Distribution”). Since the separation, CSWI has been an independent, publicly-traded company, listed on the Nasdaq Global Select Market.

Item 1A: Risk Factors

Consider carefully the following risk factors, which we believe are the principal risks that we face and of which we are currently aware, and the other information in this Annual Report, including our consolidated financial statements and related notes to those financial statements. It is possible that additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations. Furthermore, the impact of the COVID-19 pandemic may exacerbate the risks discussed in this Annual Report, which could have a material effect on the Company.

Market, Economic and Geopolitical Risks

Adverse changes in global economic conditions, particularly in the U.S. and including changes resulting from the effects of the COVID-19 pandemic, could materially adversely affect our financial position, results of operations and cash flows.

Our served industries and key end markets are affected by changes in economic conditions outside our control, which can affect our business in many ways. We are closely monitoring the potential impact on our business resulting from the COVID-19 pandemic and the corresponding decline in economic activity, in particular the effect it may have on demand for our products in the short and long term. Reduced demand may cause us and our competitors to compete on the basis of price, which would have a negative impact on our revenues and profitability. In turn, this could cause us to not be able to satisfy the financial and other covenants to which we are subject under our existing indebtedness. Reduced demand may also hinder our growth plans and otherwise delay or impede execution of our long-term strategic plan and capital allocation strategy. If there is deterioration in the general economy or in the industries we serve, our business, results of operations and financial condition could be materially adversely affected.

The industries in which we operate are highly competitive, and many of our products are in highly competitive markets. We may lose market share to producers of other products that directly compete with or that can be substituted for our products.

The industries in which we operate are highly competitive, and we face significant competition from both large domestic and international competitors and from smaller regional competitors. Our competitors may improve their competitive position in our served markets by successfully introducing new or substitute products, improving their manufacturing processes or expanding their capacity or manufacturing facilities. Further, some of our competitors benefit from advantageous cost positions that could make it increasingly difficult for us to compete in markets for less-differentiated applications. If we are unable to keep pace with our competitors’ products and manufacturing process innovations or cost position, our financial condition and results of operations could be materially adversely affected.

Certain end markets that we serve are cyclical, which can cause significant fluctuations in our results of operations and cash flows.

The cyclical nature of the supply and demand balance of certain end markets that we serve, including manufacturing, construction, energy and mining, poses risks to us that are beyond our control and can affect our operating results. These markets are highly competitive; are driven to a large extent by end-use markets; and may experience overcapacity, all of which may affect demand for and pricing of our products and result in volatile operating results and cash flows over our business cycle. Our operations and earnings may also be significantly affected by changes in oil, gas and petrochemical prices and drilling activities, which depend on local, regional and global events or conditions that affect supply and demand for the relevant commodity. Additionally, the cyclical nature of these end markets could be further exaggerated or interrupted by the effects of the COVID-19 pandemic, which in turn could significantly affect demand for our products. Product demand may not be sufficient to utilize current or future capacity. Excess industry capacity may continue to depress our volumes and margins on some products. Our operating results, accordingly, may be volatile as a result of excess industry capacity, as well as from rising energy and raw materials costs.

Growth of our business will depend in part on market awareness of our industrial brands, and any failure to develop, maintain, protect or enhance our industrial brands would hurt our ability to retain or attract customers.

We believe that building and maintaining market awareness, brand recognition and goodwill is critical to our success. This will depend largely on our ability to continue to provide high-quality products, and we may not be able to do so effectively. Our efforts in developing our industrial brands may be affected by the marketing efforts of our competitors and our reliance on our independent dealers, distributors and strategic partners to promote our industrial brands effectively. If we are unable to cost-effectively maintain and increase positive awareness of our industrial brands, our businesses, results of operations and financial condition could be harmed.

While we seek to mitigate our business risks associated with climate change, we recognize that there are inherent climate related risks wherever business is conducted, and climate change could create physical and financial risk to our business. Physical risks from climate change could, among other things, include an increase in extreme weather events (such as floods, tornados or hurricanes), limitations on availability in water and reliable energy, and the health and well-being of individuals in communities where we conduct business. Additionally, climate change-driven environmental and social regulations may negatively impact our business, our customers or our suppliers, in terms of availability and cost of natural resources, product demand or manufacturing. Such events have the potential to disrupt our business, our third-party suppliers or the businesses of our customers, which in turn could have an adverse effect on our financial condition and results of operations.

Item 2: Properties

Properties

Our principal executive offices are located at 5420 Lyndon B. Johnson Freeway, Suite 500, Dallas, Texas 75240. Our headquarters is a leased facility. The current lease term expires August 31, 2026, but may be renewed.

We consider the many manufacturing and R&D facilities, distribution centers, warehouses, offices and other properties that we own or lease to be in good condition and generally suitable for the purposes for which they are used. The following table presents our principal physical locations by segment and excludes facilities classified as discontinued operations.

| Location | Use | Segment | Square Footage |

Owned/Leased | ||||

| Boise, Idaho | Manufacturing, Office and R&D | Industrial Products | 42,000 | Leased | ||||

| Dong Nai, Vietnam | Manufacturing and Office | Industrial Products | 634,000 | Owned | ||||

| Fall River, Massachusetts | Manufacturing and Office | Both | 140,200 | Leased | ||||

| Greenwood, Indiana | Distribution Center & Office | Industrial Products | 54,000 | Leased | ||||

| Houston, Texas | Manufacturing, Office, R&D and Warehouse | Both | 253,900 | Owned | ||||

| Houston, Texas | Distribution Center & Office | Industrial Products | 150,000 | Leased | ||||

| Hudson, Florida | Manufacturing, Office and R&D | Industrial Products | 40,000 | Leased | ||||

| Jacksonville, Florida | Distribution Center & Office | Industrial Products | 217,000 | Leased | ||||

| North East, Maryland | Distribution Center & Office | Industrial Products | 150,000 | Leased | ||||

| Rockwall, Texas | Manufacturing, Office, R&D and Warehouse | Both | 227,600 | Owned | ||||

| Santa Fe Springs, California | Distribution Center & Office | Industrial Products | 240,000 | Leased | ||||

| Wichita, Kansas | Manufacturing and Office | Industrial Products | 42,800 | Owned | ||||

| Windsor, Ontario, Canada | Manufacturing, Office and R&D | Industrial Products | 42,000 | Leased |

We believe that our facilities are adequate for our current operations. We may endeavor to selectively reduce or expand our existing lease commitments as circumstances warrant. See Note 8 to our consolidated financial statements included in Item 8 of this Annual Report for additional information regarding our lease obligations.

Item 3: Legal Proceedings

We may, from time to time, be involved in litigation arising out of our operations in the normal course of business or otherwise. Furthermore, third parties may try to seek to impose liability on us in connection with the activities of our operating companies. We are not currently a party to any legal proceedings that, individually or in the aggregate, are expected to have a material effect on our business, financial condition, results of operations or financial statements, taken as a whole.

Item 6: Selected Financial Data

| Year Ended March 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| (Amounts in thousands, except per share data) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||

| RESULTS OF OPERATIONS | (a),(b) | (c),(d) | (e),(f) | (g) | (h) | |||||||||||||||

| Revenues, net | 419,205 | 385,871 | 350,155 | 326,222 | 287,460 | |||||||||||||||

| Gross profit | 184,800 | 177,050 | 161,370 | 147,940 | 128,956 | |||||||||||||||

| Selling, general and administrative expenses | (125,330 | ) | (110,032 | ) | (100,930 | ) | (98,281 | ) | (95,601 | ) | ||||||||||

| Operating income | 59,470 | 66,067 | 60,440 | 49,659 | 32,040 | |||||||||||||||

| Interest expense, net | (2,383 | ) | (1,331 | ) | (1,442 | ) | (2,317 | ) | (2,695 | ) | ||||||||||

| Provision for income taxes | (10,830 | ) | (12,784 | ) | (15,389 | ) | (15,565 | ) | (14,360 | ) | ||||||||||

| Income from continuing operations | 40,288 | 44,817 | 46,052 | 32,682 | 17,800 | |||||||||||||||

| Diluted earnings per share – continuing operations | 2.66 | 2.95 | 2.96 | 2.09 | 1.12 | |||||||||||||||

| Cash dividends per share | 0.54 | 0.54 | — | — | — | |||||||||||||||

| FINANCIAL CONDITION | ||||||||||||||||||||

| Working capital | 131,805 | 90,899 | 102,095 | 82,713 | 108,547 | |||||||||||||||

| Total assets | 874,957 | 369,245 | 352,632 | 340,816 | 398,427 | |||||||||||||||

| Total debt | 242,337 | 10,898 | 31,459 | 24,020 | 73,207 | |||||||||||||||

| Retirement obligations and other liabilities | 138,420 | 23,021 | 8,092 | 6,738 | 14,844 | |||||||||||||||

| Total equity | 412,013 | 276,741 | 263,686 | 265,765 | 272,438 | |||||||||||||||

| (a) | Result of operations in the year ended March 31, 2021 included transaction expenses related to the TRUaire acquisition and the formation of a joint venture within our Specialty Chemicals segment of $10.4 million ($8.8 million, net of tax). |

| (b) | Result of operations in the year ended March 31, 2021 included an indemnification expense of $5.0 million ($0.3 million net benefit after considering a tax benefit of $5.3 million resulting from the release of the relevant tax contingency reserves) due to the partial release of a tax indemnification asset related to the TRUaire acquisition. |

| (c) | Result of operations in the year ended March 31, 2020 included a charge of $6.5 million ($5.0 million, net of tax) resulting from the termination of our qualified U.S. defined benefit pension plan. |

| (d) | Results of operations and financial condition for the year ended March 31, 2020 reflect the adoption of ASU No. 2016-02 “Leases (Topic 842),” as amended. |

| (e) | Results of operations in the year ended March 31, 2019 included gains of $2.6 million ($1.9 million, net of tax) on sales of property, plant and equipment used in operations and $1.5 million ($2.4 million including tax benefit resulting from tax basis loss) on sales of non-operating assets. |

| (f) | Results of operations for the year ended March 31, 2019 reflect the adoption of ASU No. 2014-09 “Revenue from Contracts with Customers (Topic 606),” as amended. |

| (g) | Results of operations for the year ended March 31, 2018 included costs of $1.4 million ($0.9 million, net of tax) resulting from restructuring and realignment initiatives. |

| (h) | Results of operations for the year ended March 31, 2017 included costs of $6.6 million ($4.3 million, net of tax) resulting from restructuring and realignment initiatives. |

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis is provided to increase the understanding of, and should be read in conjunction with, the accompanying consolidated financial statements and notes. See “Item 1A. Risk Factors” and the “Forward-Looking Statements” included in this Annual Report for a discussion of the risks, uncertainties and assumptions associated with these statements. Unless otherwise noted, all amounts discussed herein are consolidated.

Executive Overview

We are a diversified industrial growth company with well-established, scalable platforms and domain expertise across two segments: Industrial Products and Specialty Chemicals. Our broad portfolio of leading products and systems provides performance optimizing solutions to our customers, helping contractors do their jobs better, faster and easier; making buildings safer and more aesthetically pleasing; protecting valuable assets from corrosion; and improving the reliability of mission critical equipment. Our products include mechanical products for heating, ventilation, air conditioning and refrigeration (“HVAC/R”), grilles, registers and diffusers, building safety solutions and high-performance specialty lubricants and sealants. End markets that we serve include HVAC/R, architecturally-specified building products, plumbing, energy, rail, mining and general industrial. Our manufacturing operations are concentrated in the United States (“U.S.”), Canada and Vietnam, and we have distribution operations in U.S., Australia, Canada and the United Kingdom (“U.K.”). Our products are sold directly or through designated channels both domestically and internationally.

Many of our products are used to protect the capital assets of our customers that are expensive to repair or replace and are critical to their operations. We have a source of recurring revenue from the maintenance, repair and overhaul and consumable nature of many of our products. We also provide some custom engineered products that strengthen and enhance our customer relationships. The reputation of our product portfolio is built on more than 100 well-respected brand names, such as RectorSeal No. 5, KOPR-KOTE, Jet-Lube, Smoke Guard, Safe-T-Switch, Mighty Bracket, Balco, Whitmore Rail, Air Sentry, Oil Safe, Deacon, Leak Freeze, Greco and TRUaire.

On April 1, 2021, Whitmore Manufacturing, LLC (“Whitmore”), a wholly-owned subsidiary of CSWI, completed the formation of the previously announced joint venture with Pennzoil-Quaker State Company dba SOPUS products (“Shell”), a wholly-owned subsidiary of Shell Oil Company that comprises Shell’s U.S. lubricants business. The formation was consummated through a transaction in which Whitmore sold to Shell a 50% interest in a wholly-owned subsidiary (containing certain existing operating assets) in exchange for consideration of $13.7 million from Shell in the form of cash and intangible assets.

On December 15, 2020, we acquired 100% of the outstanding equity of T.A. Industries, Inc. (“TRUaire”), a leading manufacturer of grilles, registers, and diffusers for the residential and commercial HVAC/R end market, based in Santa Fe Springs, California. The acquisition also included TRUaire’s wholly-owned manufacturing facility based in Vietnam. The acquisition is expected to extend the Company’s product offerings to the HVAC market as well as add new customers and provide strategic distribution facilities. The consideration paid for TRUaire included cash of $284 million and 849,852 shares of the Company’s common stock. The cash consideration was funded through a combination of cash on hand and borrowings under our revolving credit facility, and 849,852 shares of common stock were reissued from treasury shares. TRUaire activity has been included in our Industrial Products segment since the acquisition date.

During the quarter ended December 31, 2017, we committed to a plan to divest our Strathmore Products business (the “Coatings business”). This determination resulted in the reclassification of the assets comprising that business to assets held-for-sale, and a corresponding adjustment to our consolidated statements of operations to reflect discontinued operations for all periods presented. During the quarter ended September 30, 2018, we received an aggregate of $6.9 million for the sale of certain tangible and all intangible assets that related to our former Coatings business in multiple transactions. During the quarter ended March 31, 2020, we received $1.5 million for the sale of the last remaining real property owned by our former Coatings business and, as such, we do not expect to have results of discontinued operations resulting from the Coatings business in future years.

The COVID-19 pandemic continues to have an impact on human health, the global economy and society at large. The pandemic and its resulting impacts had an adverse impact on our financial results in the fiscal year ended March 31, 2021, as compared with the prior year, most notably within the first and second quarters of fiscal 2021. While the COVID-19 pandemic has contributed to increased demand in certain parts of our business, including the HVAC/R end market, we expect our overall results of operations and financial condition to continue to be adversely impacted through the duration of the pandemic when compared to pre-pandemic periods. Despite strong demand in certain of our end markets and signs of recovery in others, we cannot reasonably estimate the magnitude or length of the pandemic’s adverse impact, including the effects of any vaccine or its ultimate impact on our business or financial condition, due to continued uncertainty regarding (1) the duration and severity of the COVID-19 pandemic and (2) the continued potential for short and long-term impacts on our facilities and employees, customer demand and supply chain.

All of our operations and products support critical infrastructure and are considered “essential” in all of the relevant jurisdictions in which we operate. In response to the COVID-19 pandemic, we took numerous measures across our operating sites to ensure we continue to place the highest priority on the health, safety and well-being of our employees, while continuing to support our customers. Through the date of this filing, our businesses have continued to operate throughout the COVID-19 pandemic with appropriate safeguards for our employees and without any material disruptions.

The HVAC/R market is our largest market served and it represented approximately 42% and 31% of our net revenues in the years ended March 31, 2021 and 2020, respectively. We provide an extensive array of products for installation, repair and maintenance of HVAC/R systems that includes condensate switches, pans and pumps, grilles, registers and diffusers, refrigerant caps, line set covers and other chemical and mechanical products. The industry is driven by replacement and repair of existing HVAC/R systems, as well as new construction projects. New HVAC/R systems are heavily influenced by macro trends in building construction, while replacement and repair of existing HVAC/R systems are dependent on weather and age of unit. The HVAC/R market tends to be seasonal with the peak sales season beginning in March and continuing through August. Construction and repair is typically performed by contractors, and we utilize our global distribution network to drive sales of our brands to such contractors.

Architecturally-specified building products represented approximately 27% and 29% of our net revenues in the years ended March 31, 2021 and 2020, respectively. We manufacture and sell products such as engineered railings, smoke and fire protection systems, expansion joints and stair edge nosings for commercial buildings, multi-family housing, healthcare, education and government facilities. Sales of these products are driven by architectural specifications and safety codes. The sales process is typically long as these can be multi-year construction projects. The construction market, both commercial and multi-family, is a key driver for sales of architecturally-specified building products.

The general industrial end market represented approximately 10% and 13% of our net revenues in the years ended March 31, 2021 and 2020, respectively. We provide products focused on asset protection and reliability, including lubricants, desiccant breathers and fluid management products. The general industrial market includes the manufacture of chemicals, steel, cement, food and beverage, pulp and paper and a wide variety of other processed materials. We serve this market primarily through a network of distributors. The growth trajectory of the general industrial end market is expected to reflect a blended average of the aforementioned end use markets.

The plumbing market represented approximately 10% and 11% of our net revenues in the years ended March 31, 2021 and 2020, respectively. We provide many products to the plumbing industry including thread sealants, solvent cements, fire-stopping products, condensate switches and trap guards, as well as other mechanical products, such as drain traps. Installation is typically performed by contractors, and we utilize our global distribution network to drive sales of our products to contractors.

The energy market represented approximately 4% and 6% of our net revenues in the years ended March 31, 2021 and 2020, respectively. We provide market-leading lubricants and anti-seize compounds, as well as greases, for use in oilfield drilling activity and maintenance of oilfield drilling and valve related equipment. We sell our products primarily through distributors that are strategically situated near the major oil and gas producing areas across the globe. The outlook for the energy industry is heavily dependent on the global demand expectations from developed and emerging economies, as well as oil price and local government policies relative to oil exploration, drilling, storage and transportation.

The rail market represented approximately 4% and 6% of our net revenues in the years ended March 31, 2021 and 2020, respectively. We provide an array of products into the rail industry, including lubricants and lubricating devices for rail lines, which increase efficiency, reduce noise and extend the life of rail equipment such as rails and wheels. We leverage our technical expertise to build relationships with key decision-makers to ensure our products meet required specifications. We sell our products primarily through a direct sales force, as well as through distribution partners. End markets for Rail include Class 1 Rail as the primary end market in North America and Transit Rail as the primary end market in all other geographies. Cyclical product classes such as farm products and petrochemical products can also impact volumes in Class 1 Rail. While coal transport is diminishing demand for Class 1 Rail in North America, global investment in Transit Rail systems is expected to more than offset this decline.

The mining market represented approximately 3% and 4% of our net revenues in the years ended March 31, 2021 and 2020, respectively. Across the globe, we provide market-leading lubricants to open gears used in large mining excavation equipment, primarily through direct sales agents, as well as a network of strategic distributors. The North American mining industry is heavily weighted toward coal production and has experienced headwinds due to continued decline in domestic coal demand, partially mitigated by the seaborne coal export market. Globally, coal demand has been robust, and focused efforts in coal markets outside of the U.S., coupled with enhanced focus on markets such as iron, gold, diamonds and uranium in Southeast Asia, South America, Africa and Russia, have delivered growth that has generally offset the weakness in North American coal demand. Outside of coal, the mining market tends to move with global industrial output as basic industrial metals such as copper, tin, aluminum, and zinc, which are critical inputs to many industrial products.

We expect to maintain a strong balance sheet in fiscal year 2022, which provides us with access to capital through our cash on hand, internally-generated cash flow and availability under our revolving credit facility. Our capital allocation strategy continues to guide our investing decisions, with a priority to direct capital to the highest risk adjusted return opportunities, within the categories of organic growth, strategic acquisitions and the return of cash to shareholders through our share repurchase and dividend programs. With the strength of our financial position, we will continue to invest in financially and strategically attractive expanded product offerings, key elements of our long-term strategy of targeting long-term profitable growth. We will continue to invest our capital in maintaining our facilities and in continuous improvement initiatives. We recognize the importance of, and remain committed to, continuing to drive organic growth, as well as investing additional capital in opportunities with attractive risk-adjusted returns, driving increased penetration in the end markets we serve.

Item 7A: Quantitative and Qualitative Disclosures About Market Risk

We are exposed to market risk from changes in interest rates and foreign currency exchange rates, which may adversely affect our consolidated financial position and results of operations. We seek to minimize these risks through regular operating and financing activities, and when deemed appropriate, through the use of interest rate swaps. It is our policy to enter into interest rate swaps only to the extent considered necessary to meet our risk management objectives. We do not purchase, hold or sell derivative financial instruments for trading or speculative purposes.

We are subject to interest rate risk on our variable rate indebtedness. Fluctuations in interest rates have a direct effect on interest expense associated with our outstanding indebtedness. As of March 31, 2021, we had $232.0 million in outstanding variable rate indebtedness, after consideration of the interest rate swap. We manage, or hedge, interest rate risks related to our borrowings by means of interest rate swap agreements. At March 31, 2021, we had an interest rate swap agreement that covered 4.3% of our $242.3 million of our total outstanding indebtedness. At March 31, 2021, we had $232.0 million in unhedged variable rate indebtedness with a weighted average interest rate of 2.11%. Each quarter point change in interest rates would result in a change of approximately $0.6 million in our interest expense on an annual basis.

We may also be exposed to credit risk in derivative contracts we may use. Credit risk is the failure of the counterparty to perform under the terms of the derivative contract. If the fair value of a derivative contract is positive, the counterparty will owe us, which creates credit risk for us. If the fair value of a derivative contract is negative, we will owe the counterparty and, therefore, do not have credit risk. We have sought to minimize the credit risk in derivative instruments by entering into transactions with high-quality counterparties.

We conduct a small portion of our operations outside of the U.S. in currencies other than the U.S. dollar. Our non-U.S. operations are conducted primarily in their local currencies, which are also their functional currencies, and include the Australian dollar, British pound, Canadian dollar and Vietnamese dong. Foreign currency exposures arise from translation of foreign-denominated assets and liabilities into U.S. dollars and from transactions denominated in a currency other than a non-U.S. operation’s functional currency. We realized net (losses) gains associated with foreign currency translation of $4.8 million, $(2.3) million and $(2.0) million for the years ended March 31, 2021, 2020 or 2019, respectively, which are included in accumulated other comprehensive income (loss). We recognized foreign currency transaction net gains (losses) of $(0.9) million, $0.3 million and $0.4 million for the years ended March 31, 2021, 2020 or 2019, respectively, which are included in other income (expense), net on our consolidated statements of operations.

Based on a sensitivity analysis at March 31, 2021, a 10% change in the foreign currency exchange rates for the year ended March 31, 2021 would have impacted our income from continuing operations by less than 1%. This calculation assumes that all currencies change in the same direction and proportion relative to the U.S. dollar and that there are no indirect effects, such as changes in non-U.S. dollar sales volumes or prices.

Item 8: Financial Statements and Supplementary Data

Report of Independent Registered Public Accounting Firm

We have audited the accompanying consolidated balance sheets of CSW Industrials, Inc. (a Delaware corporation) and subsidiaries (the “Company”) as of March 31, 2021 and 2020, the related consolidated statements of operations, comprehensive income (loss), equity and cash flows for each of the three years in the period ended March 31, 2021, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of March 31, 2021 and 2020, and the results of its operations and its cash flows for each of the three years in the period ended March 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), the Company’s internal control over financial reporting as of March 31, 2021, based on criteria established in the 2013 Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”), and our report dated May 20, 2021 expressed an unqualified opinion.

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

The critical audit matter communicated below is a matter arising from the current period audit of the financial statements that was communicated or required to be communicated to the audit committee and that: (1) relates to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

As described in Note 2 of the consolidated financial statements, the Company completed its acquisition of T.A. Industries, Inc. (“TRUaire”) for a total purchase price of approximately $384.6 million on December 15, 2020. The Company’s accounting for the acquisition required the estimation of the fair value of assets acquired and liabilities assumed, which included a preliminary purchase price allocation of identifiable intangible assets of $202.5 million to customer lists and $43.5 million to a tradename. We have identified the valuation of customer lists and tradename to be a critical audit matter.

The principal consideration for our determination that the valuation of customer lists and tradename is a critical audit matter is the significant estimation uncertainty involved in determining fair value. The significant assumptions used to estimate the fair value of the identifiable intangible assets included the discount rates, royalty rate, and forecasted revenue growth rates and gross profit margins. These significant assumptions are forward-looking and could be affected by future changes in economic and market conditions and require significant auditor judgment in evaluating the reasonableness of the assumptions.

Our audit procedures related to the valuation of customer lists and tradename included the following, among others. We tested the design and operating effectiveness of the Company’s internal controls over accounting for the TRUaire acquisition, including controls over the recognition and measurement of the customer lists and trade name intangible assets and management’s judgments and evaluation of the underlying assumptions with regard to the valuation model applied.

We evaluated the significant assumptions used by comparing the forecasted revenue growth rates and gross profit margins to current industry and market trends and to the historical results of the acquired TRUaire business. In addition, we involved valuation specialists to assist in our evaluation of the valuation methodology and reasonableness of significant assumptions used by the Company. These procedures included developing a range of independent estimates for the discount rates and royalty rate and comparing those to the rates selected by management as well as performing sensitivity analyses of significant assumptions to evaluate the changes in the fair value of the acquired customer lists and trade name intangible assets that would result from changes in the assumptions.

Item 9A: Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”)) are designed to ensure that the information, which we are required to disclose in the reports that we file or submit under the Exchange Act, is recorded, processed, summarized and reported within the time periods specified in the United States Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including our Principal Executive Officer and Principal Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

In connection with the preparation of this Annual Report on Form 10-K for the year ended March 31, 2021, our management, under the supervision and with the participation of our Principal Executive Officer and our Principal Financial Officer, carried out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as of March 31, 2021 as required by Rule 13a-15(b) under the Exchange Act. Based on this evaluation, our Principal Executive Officer and Principal Financial Officer concluded that our disclosure controls and procedures were effective at the reasonable assurance level as of March 31, 2021.

Item 9B: Other Information

On May 18, 2021, we entered into a Second Amended and Restated Credit Agreement (the “Second Credit Agreement”) with JPMorgan Chase Bank, N.A., as administrative agent (in such capacity, the “Administrative Agent”) and collateral agent, and the lenders, issuing banks and swingline lender party thereto. CSW Industrials Holdings, LLC, a wholly-owned subsidiary of the Company (the “Borrower”), is the borrower under the Second Credit Agreement. The Second Credit Agreement provides for a $400.0 million revolving credit facility that contains a $25.0 million sublimit for the issuance of letters of credit and a $10.0 million sublimit for swingline loans. The Second Credit Agreement is scheduled to mature on May 18, 2026.

Borrowings under the Second Credit Agreement bear interest, at the Borrower’s option, at either base rate or LIBOR, plus, in either case, an applicable margin based on the Company’s leverage ratio calculated on a quarterly basis. The base rate is described in the Second Credit Agreement as the highest of (i) the Federal funds effective rate plus 0.50%, (ii) the prime rate quoted by The Wall Street Journal, and (iii) the one-month LIBOR rate plus 1.00%.

Borrowings under the Second Credit Agreement may be used for working capital and general corporate purposes, including, without limitation, for financing permitted acquisitions and fees and expenses incurred in connection therewith.

The obligations of the Borrower under the Second Credit Agreement are guaranteed by the Company and all of its direct and indirect domestic subsidiaries. The Second Credit Agreement is secured by a first priority lien on all tangible and intangible assets and stock issued by the Borrower and its domestic subsidiaries, subject to specified exceptions, and 65% of the voting equity interests in its first-tier foreign subsidiaries.

The financial covenants contained in the Second Credit Agreement require the maintenance of a maximum Leverage Ratio of 3.00 to 1.00, subject to a temporary increase to 3.75 to 1.00 for 18 months following the consummation of permitted acquisitions with consideration in excess of certain threshold amounts set forth in the Second Credit Agreement, and the maintenance of a minimum Fixed Charge Coverage Ratio of 1.25 to 1.00, the calculations and terms of which are defined in the Second Credit Agreement. The Second Credit Agreement also contains (i) affirmative and negative covenants which are customary for similar credit agreements, including, without limitation, limitations on the Company, the Borrower and its subsidiaries with respect to indebtedness, liens, investments, distributions, mergers and acquisitions, disposition of assets and transactions with affiliates, and (ii) customary events of default.

Item 12: Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

Item 13: Certain Relationships and Related Transactions, and Director Independence

Item 15: Exhibits, Financial Statement Schedules

Exhibit Index

| EXHIBIT NUMBER |

DESCRIPTION |

| 2.1 | Stock Purchase Agreement, dated November 4, 2020, by and among RectorSeal, LLC, T.A. Industries, Inc. d/b/a TRUaire, Yongki Yi as Seller Representative, the Sellers party thereto, and solely for the purposes of Sections 1.8, 6.5(d) and 13.18, CSW Industrials, Inc. (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K, filed on November 5, 2020) |

| 3.1 | Third Amended and Restated Certificate of Incorporation of the Company (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed on August 15, 2018) |

| 3.2 | Amended and Restated Bylaws of the Company, adopted and effective August 14, 2018 (incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K, filed on August 15, 2018) |

| 4.1 | Description of Securities Registered under Section 12 of the Securities Exchange Act of 1934 (incorporated by reference to Exhibit 4.1 to the Company’s Annual Report on Form 10-K, filed on May 20, 2020) |

| 10.1 | First Amended and Restated Credit Agreement, dated as of September 15, 2017, by and among CSW Industrials Holdings, Inc., Whitmore Manufacturing, LLC, the other loan parties thereto, the lenders party thereto, and JPMorgan Chase Bank, N.A., as administrative agent (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed on September 19, 2017) |

| 10.2 | First Amendment (Incremental Amendment) to First Amended and Restated Credit Agreement, dated December 1, 2020, by and among CSW Industrials Holdings, Inc. and Whitmore Manufacturing, LLC, the other Loan Parties party thereto and JPMorgan Chase Bank, N.A., individually and in its capacity as the Administrative Agent, Swingline Lender and Issuing Bank (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed on December 1, 2020) |

| 10.3* | Second Amendment to First Amended and Restated Credit Agreement, dated March 10, 2021, by and among CSW Industrials Holdings, Inc. and Whitmore Manufacturing, LLC, the other Loan Parties party thereto and JPMorgan Chase Bank, N.A., individually and in its capacity as the Administrative Agent, Swingline Lender and Issuing Bank |

| 10.4 | Registration Rights Agreement, dated December 15, 2020, by and among CSW Industrials, Inc. and the Sellers party thereto (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed on December 16, 2020) |

| 10.5 | Form of Director and Officer Indemnification Agreement (incorporated by reference to Exhibit 10.5 to Amendment No. 3 to the Company’s Registration Statement on Form 10, filed on August 28, 2015) |

| EXHIBIT NUMBER |

DESCRIPTION |

| 10.6 | Amended and Restated CSW Industrials, Inc. 2015 Equity and Incentive Compensation Plan (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K, filed on December 12, 2016) + |

| 10.7 | Employment agreement by and between CSW Industrials, Inc. and Joseph Armes, dated October 1, 2015 (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q, filed on February 16, 2016) + |

| 10.8 | Form of Employee Time Vested Restricted Share Award Agreement (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q, filed on February 8, 2018)+ |

| 10.9 | Form of Employee Time Vested Restricted Stock Unit Award Agreement (incorporated by reference to Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q, filed on February 8, 2018)+ |

| 10.10 | Form of Employee Performance Share Award Form of Employee Performance Share Award Agreement (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q, filed on August 8, 2019) + |

| 10.11 | Form of Non-Employee Director Time Vested Restricted Share Award Agreement (incorporated by reference to Exhibit 10.3 to the Company’s Quarterly Report on Form 10-Q, filed on February 8, 2018)+ |

| 10.12 | Form of Non-Qualified Stock Option Right Award Agreement (executive compensation plan – replacement award agreement) (incorporated by reference to Exhibit 10.8 to the Company’s Quarterly Report on Form 10-Q, filed on February 16, 2016) + |

| 10.13 | CSW Industrials, Inc. Executive Change in Control and Severance Benefit Plan (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on December 12, 2016) + |

| 21.1* | List of subsidiaries of the Company |

| 23.1* | Consent of Grant Thornton LLP |

| 31.1* | Certification of Principal Executive Officer pursuant to Exchange Act Rules 13a-14(a) and 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2* | Certification of Principal Financial Officer pursuant to Exchange Act Rules 13a-14(a) and 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1** | Certification of Principal Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes- Oxley Act of 2002 |

| 32.2** | Certification of Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes- Oxley Act of 2002 |

| 101.INS | XBRL Instance Document |

| 101.SCH | XBRL Taxonomy Extension Schema |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

Signatures

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized:

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated:

| Name | Title | Date | |||

| /S/ JOSEPH B. ARMES | Chief Executive Officer | May 20, 2021 | |||

| Joseph B. Armes | (Principal Executive Officer) | ||||

| /S/ JAMES E. PERRY | Chief Financial Officer | May 20, 2021 | |||

| James E. Perry | (Principal Financial and Accounting Officer) | ||||

| /S/ MICHAEL R. GAMBRELL | Director | May 20, 2021 | |||

| Michael R. Gambrell | |||||

| /S/ TERRY L. JOHNSTON | Director | May 20, 2021 | |||

| Terry L. Johnston | |||||

| /S/ LINDA A. LIVINGSTONE | Director | May 20, 2021 | |||

| Linda A. Livingstone, Ph.D. | |||||

| /S/ WILLIAM F. QUINN | Director | May 20, 2021 | |||

| William F. Quinn | |||||

| /S/ ROBERT M. SWARTZ | Director | May 20, 2021 | |||

| Robert M. Swartz | |||||

| /S/ J. KENT SWEEZEY | Director | May 20, 2021 | |||

| J. Kent Sweezey | |||||

| /S/ DEBRA L. VON STORCH | Director | May 20, 2021 | |||

| Debra L. von Storch |

CSW INDUSTRIALS

Directors and Officers

|

JOSEPH B. ARMES Chairman, Chief Executive Officer and President |

|

MICHAEL R. GAMBRELL Former Executive Vice President of Dow Chemical | |

|

TERRY L. JOHNSTON Former Executive Vice President and COO of Lennox International, Inc. Commercial Segment |

|

LINDA A. LIVINGSTONE, PH.D. President of Baylor University | |

|

WILLIAM F. QUINN Former Executive Chairman and Founder of American Beacon Advisors |

|

ROBERT M. SWARTZ Former Executive Vice President and Chief Operating Officer of Glazer’s Inc. | |

|

J. KENT SWEEZY Founding Partner of Turnbridge Capital, LLC |

|

DEBRA L. VON STORCH Former Partner,Ernst & Young LLP |

| TRANSFER AGENT AST Brooklyn, New York T (800) 937-5449 www.amstock.com |

STOCK LISTING NASDAQ Symbol: CSWI |

INDEPENDENT PUBLIC ACCOUNTANTS Grant Thornton LLP Dallas, Texas |

ANNUAL MEETING August 14, 2020 Hilton Dallas Lincoln Centre 5410 Lyndon B. Johnson Freeway Dallas, Texas 75240 |

CONTACT INFORMATION CSW Industrials, Inc. 5420 Lyndon B. Johnson Freeway Suite 500 Dallas, Texas 75240 T (214) 884-3777 F (214) 279-7101 www.cswindustrials.com |